Set up limit definitions

Limit definitions are the investment constraints you want to follow. They include the values to follow and thresholds for warnings and breaches.

Limit definitions are organized into groups. For example, you can group individual limit definitions that set proportions of different security types in a portfolio. Grouping lets you link multiple limit definitions to a portfolio at once and facilitates their monitoring. In addition, groups are useful in automatic analysis, scheduling and monitoring of limits: you can schedule to analyze different groups at different intervals and set up different kinds of monitoring for different limit groups.

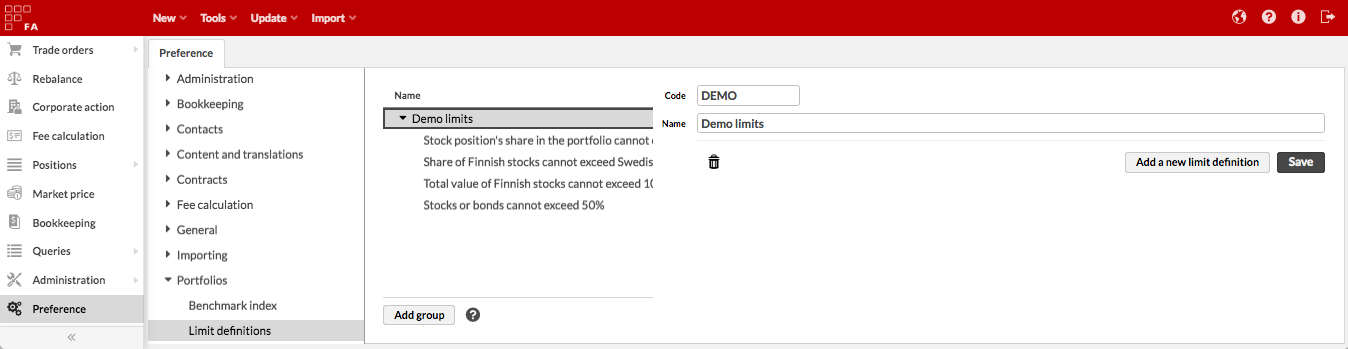

You can set up limit definitions in Preferences → Portfolios → Limit definitions:

Create a limit group: click Add group and enter a unique code and a name you want to see in the portfolio limits. A limit group is a "container" for individual limit definitions that allows you to manage similar limits together. Examples of limit groups: "UCITS limits", "Allocation limits" or similar.

Create individual limit definitions in your limit group: click Add a new limit definition and fill in the fields:

- Code

A unique code for your limit definition.

- Name

A descriptive name for your limit definition. The name is used to search for the limit, link the limit to your portfolio, and show the result of the limit. Names should indicate what the limit checks, for example: "Stock position's share less than 11%" or "Total market value of Finnish stocks less than 10 000 €".

Choose the limit type and follow the instructions by the link depending on your choice.

Analytics - build your limit based on values from Analytics+, for example, market value. See Limit definitions based on Analytics

Profile - build your limit to analyze values you store in custom fields on your portfolio. See Limit definitions based on custom profile fields.

Investment plan - build your limit to analyze your portfolio against its investment plan . See Limit definitions based on strategy, investment plan or model portfolio

Model portfolio - build your limit to analyze your portfolio against its model portfolio . See Limit definitions based on strategy, investment plan or model portfolio

Strategy - build your limit to analyze your portfolio against its strategy. See Limit definitions based on strategy, investment plan or model portfolio

Set the limit thresholds:

- Minimum breach threshold

If your limit value drops below this value, your limit will be breached.

- Minimum warning threshold

If your limit value drops below this value, your limit will induce a warning.

- Maximum warning threshold

If your limit exceeds this value, your limit will induce a warning.

- Maximum breach threshold

If your limit exceeds this value, your limit will be breached.

In case of absolute values in analytics-based limits and profile values, define the thresholds with a numeric value in the same unit as your limit definition fetches.

In case of relative values in analytics-based limits, define the threshold with a numeric value between 0 and 1 - relative values are always analyzed as percentages, which are defined as a decimal number (e.g. 10% threshold defined as 0.1).

In case of values from portfolio's strategy, investment plan or model portfolio, define the thresholds with a numeric value between 0 and 100 - these values are always analyzed as percentage, which are defined as an integer (e.g. 10% threshold defined as 10).

After you set up a limit definition, you can link it to a portfolio (see Link limit definitions to portfolios) and analyze the limits pre-trade or post-trade.