Pre-trade limits check in Rebalancing

When you rebalance your portfolios and get a list of suggested trade orders in the Rebalance window, the Check limits button allows you to run an ad-hoc pre-trade limit analysis before actually saving the trade orders. This allows you to evaluate whether all the suggested orders together, considering your portfolio's current positions and all other outstanding trade orders, would breach your limits.

Pre-trade limit check is calculated with the same logic as pre-trade limits for a portfolio (see Post-trade and pre-trade limits in Portfolio window. It considers the effect of the suggested unsaved trade orders and other outstanding trade orders in the portfolio - this allows you to get a comprehensive analysis on your portfolio as a whole.

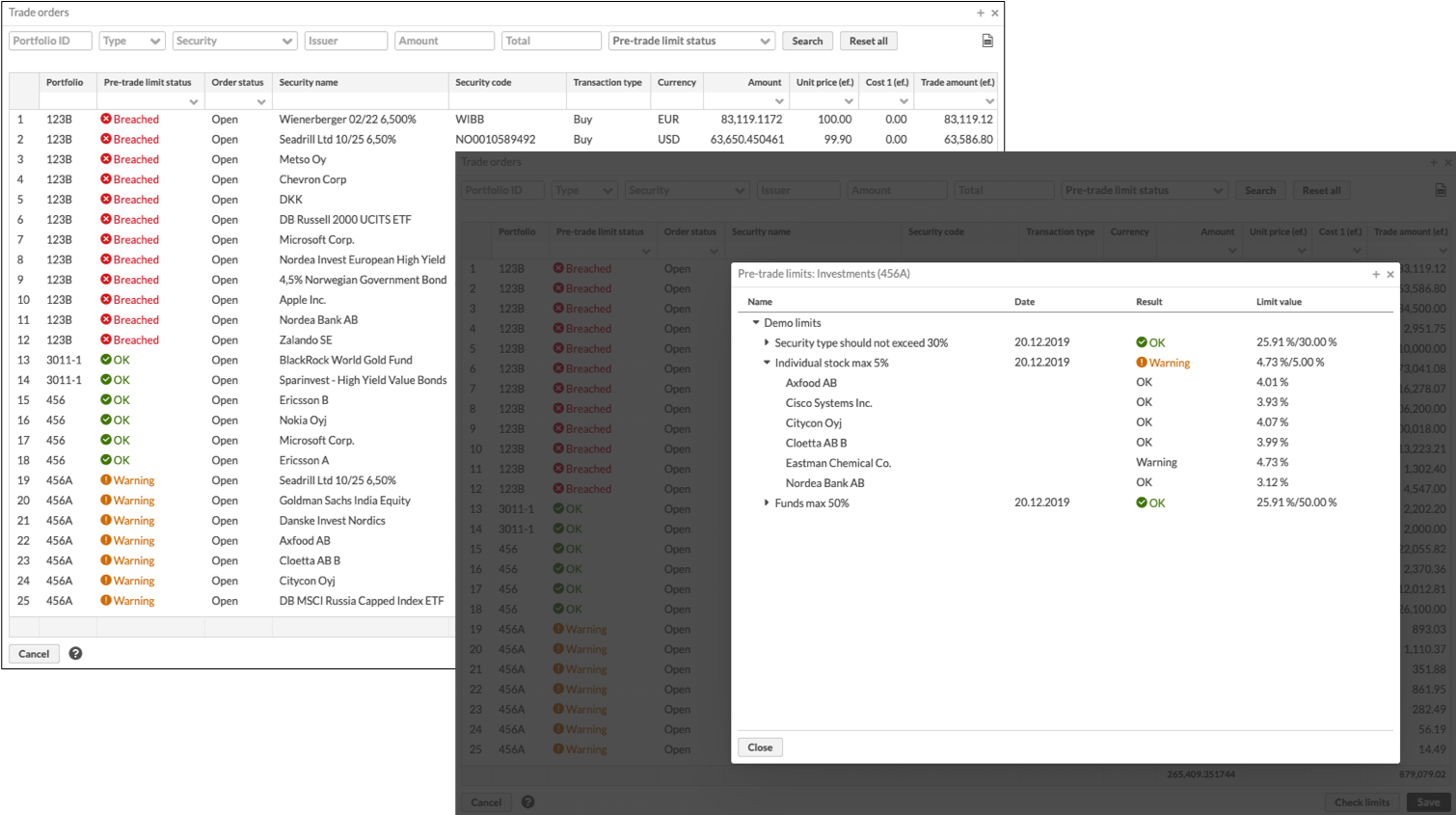

Results of the pre-trade limit check are updated in the Pre-trade limit status column. This allows you to easily see your portfolio's limit status after the check - rebalancing might suggest multiple trade orders to the same portfolio, and for all these trade orders, the pre-trade limit status shows the same result. If you want to analyze the pre-trade limit check further, you can click a row in the table to see the results of the check in a separate window. This allows you to evaluate the results of the limit check before making a decision to save or not to save the trade order.

Pre-trade limit check doesn't prevent you from saving the suggested trade orders, but provides you with tools to evaluate the orders before saving them. You can also filter the list of suggested trade orders based on the pre-trade limit status either through the table directly with a single status or through the search fields at the top with multiple statuses. This allows you to for example accept only trade orders in portfolios with the pre-trade limit status after the check as "OK" or "warning", filtering out orders in "breached" portfolios.

The results of the pre-trade limit check are not stored on your portfolio.