Create a composite investment plan

FA allows you to make a combined investment plan based on model portfolios and their respective shares. For example, you might want to build a 60/40 investment plan based on your equity model portfolio with 60 % share and fixed income model portfolio with 40 % share.

Getting started

To create a composite investment plan that includes model portfolios, you first need to create a strategy based on these model portfolios.

Build your model portfolios. For detailed information on model portfolios, refer to the FA Back reference: Model portfolio management.

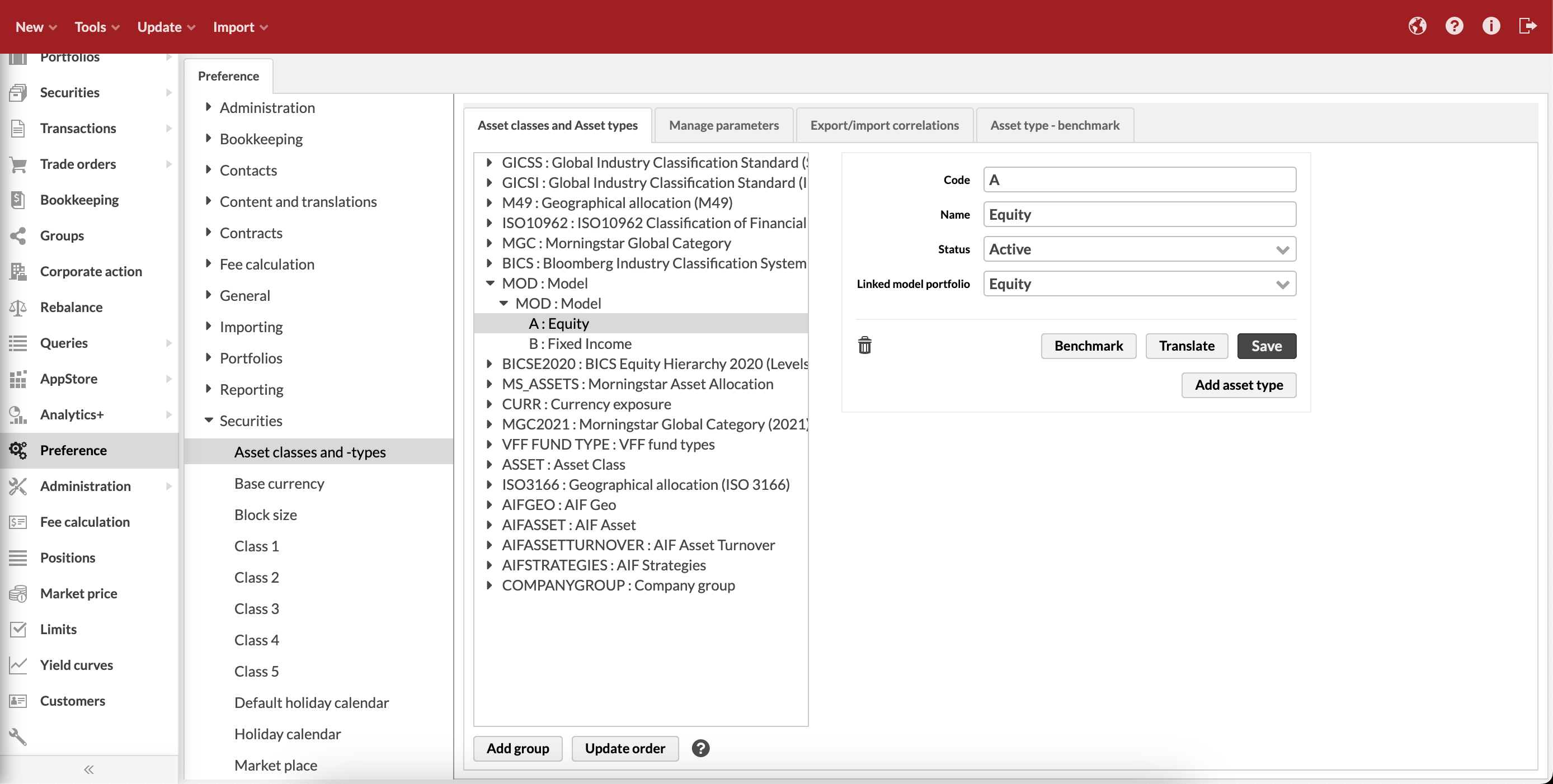

Link the model portfolios to appropriate asset types. You can choose the asset types defined under asset class with code MOD. The asset group also must have the code MOD. In this example, there are two asset types, Equity (A) and Fixed Income (B). The Equity asset type is linked to the model portfolio with the same name:

Define a strategy for the MOD asset group in your portfolio (Portfolio window, Strategy tab). Add the date from which the strategy is valid and specify the minimum and maximum percentage for each asset type. The total percentage must sum up to 100%.

For example, to build an investment plan with 60/40 strategy, set up a strategy with 60% share of the Equity asset type (as defined in the previous step) and 40% share of the Fixed income asset type.

Create a composite investment plan

To create an investment plan based on the strategy you created:

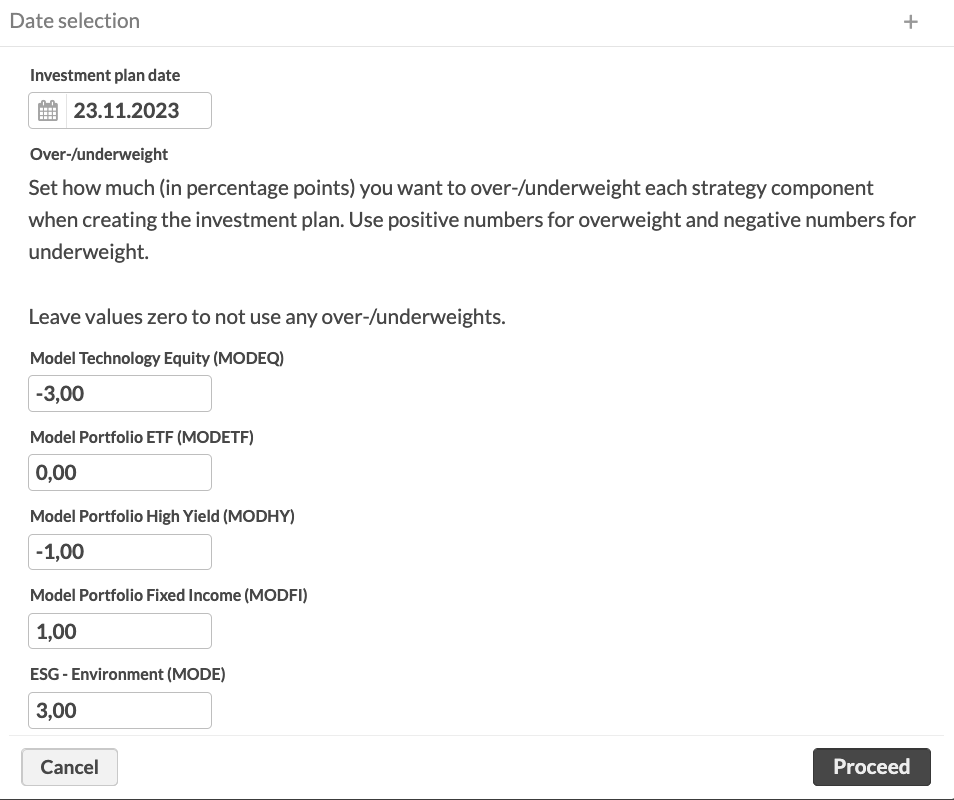

Go to the Portfolios view and filter out all the portfolios to create a composite investment plan for. Click the arrow at the bottom, then choose Rebalance → Create composite investment plan at the bottom of the page. Fill in the fields:

- Investment plan date

The starting date for the new investment plan.

- Over-/underweight

The over- and underweight values for strategy components in percentage points.

Click Proceed, check the investment plan created based on your input and click Save.

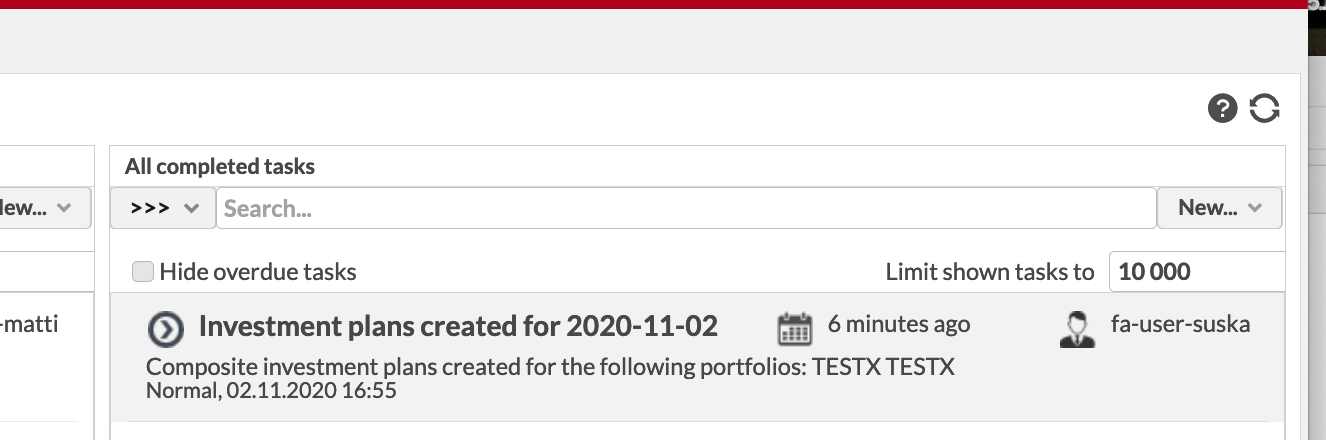

You can find the created investment plan in the Tasks view.

|

Adjust composite investment plan

You can define adjustments for the composite investment plan on the portfolio level:

Never-have rules. Never-have rules restrict trading on certain securities. If you have never-have rules defined, these rules are applied when creating a composite investment plan. To learn more about never-have rules, see Validate trade orders.

Offset factor. Investment plan can be adjusted with the portfolio-specific offset factor that is applied to over- and underweights. To define the offset factor, create a portfolio-specific key figure OFFSET_FACTOR in Preference → Content and translations → Key figures. Specify the "Double" data type. Then, add the figure and the offset factor value in the Portfolio window, Key figures tab.

Any over- and underweights will be multiplied with this factor. For example, if your strategy is to have 50 % Equity and 50 % Fixed Income, you input +10 overweight for Equity and -10 underweight for Fixed Income when creating the investment plan, and there is an offset factor of 0.5, the investment plan will feature 55 % Equity (= 50 % + (10*0.5)) and 45 % Fixed Income (= 50 % + (-10*0.5)).