Model portfolio

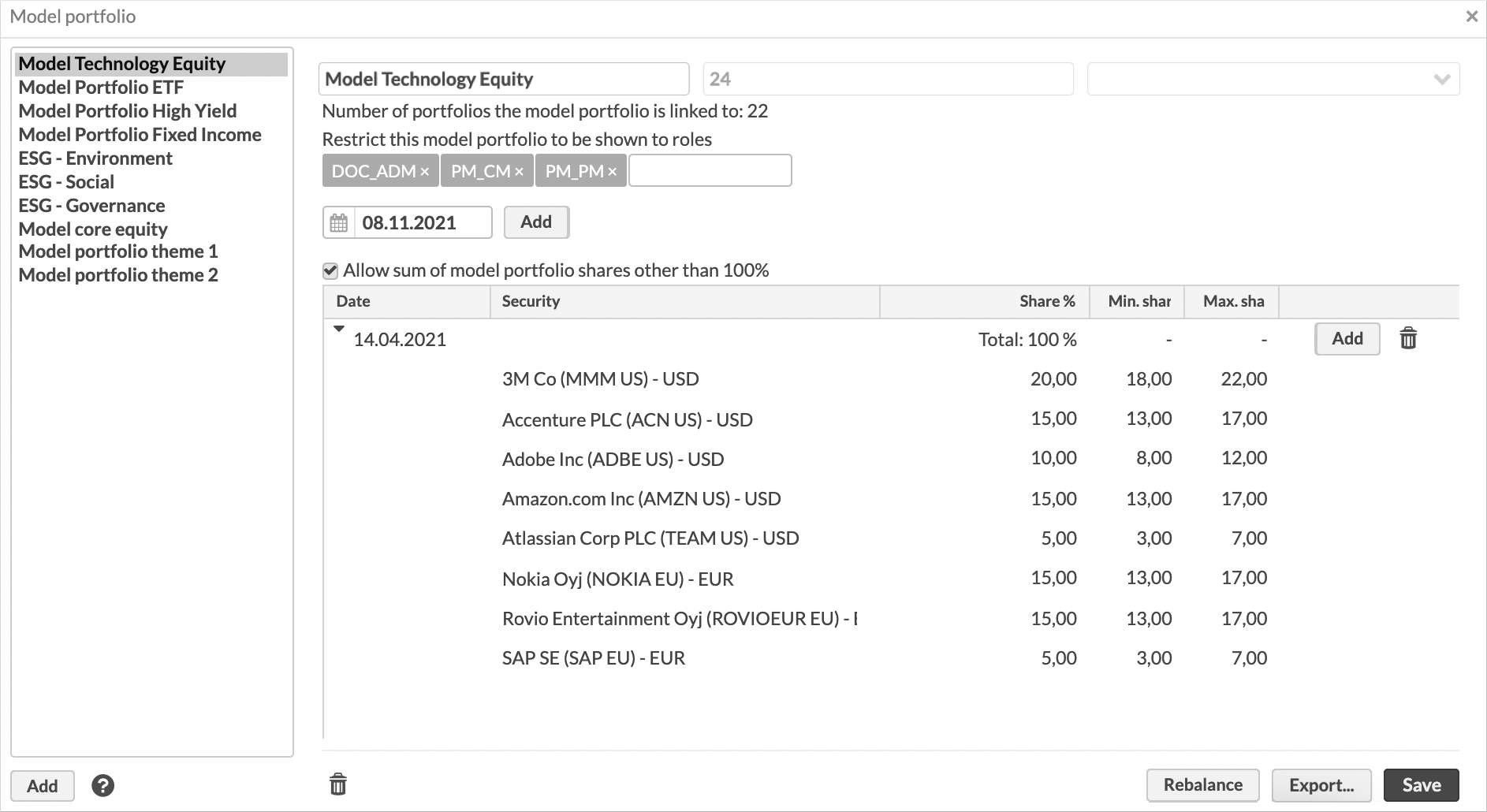

Model portfolio is a basket of investments defined in terms of the securities and their shares. Model portfolios are used for rebalancing.

There are two ways to define a model portfolio in FA:

Define a model portfolio with fluctuating content and shares.

Link the model portfolio to one of the portfolios defined in the system in the Linked portfolio field, when the securities the model portfolio consists of and the shares of these securities of the model portfolio total come from the linked portfolio. If you want to change the contents of the model portfolio, record appropriate transactions to the linked portfolio in order to alter the securities or shares in it.

Define a model portfolio with fixed content and shares.

Set the date in the Date field from which the model portfolio is valid from and define the securities the model portfolio consists of and the shares of these securities of the model portfolio total. If you want to change the contents of the model portfolio, add a new date with new securities and shares.

Create a model portfolio

To create a model portfolio:

Open the Rebalance view and click Model portfolio at the bottom of the veiw.

Click Add a new model portfolio and fill in the fields. For the field descriptions, see Model portfolio in FA Back reference.

Click Save.

After you created a model portfolio, you use it for rebalancing: see Rebalance. If you want to rebalance your portfolios against a combination of model portfolios (for example 20% of stock portfolio and 80% of bond portfolio), see Create a composite investment plan.