Limit definitions based on Analytics

When using values from Analytics+, limit definitions allow you to set the level of analysis with two-level grouping and close to 30 different grouping criteria, and extend your limit definition with filtering, sorting, limiting and summing up values. You can define your limits as absolute or relative values, and define minimum and maximum thresholds for warnings and breaches on each individual investment limit.

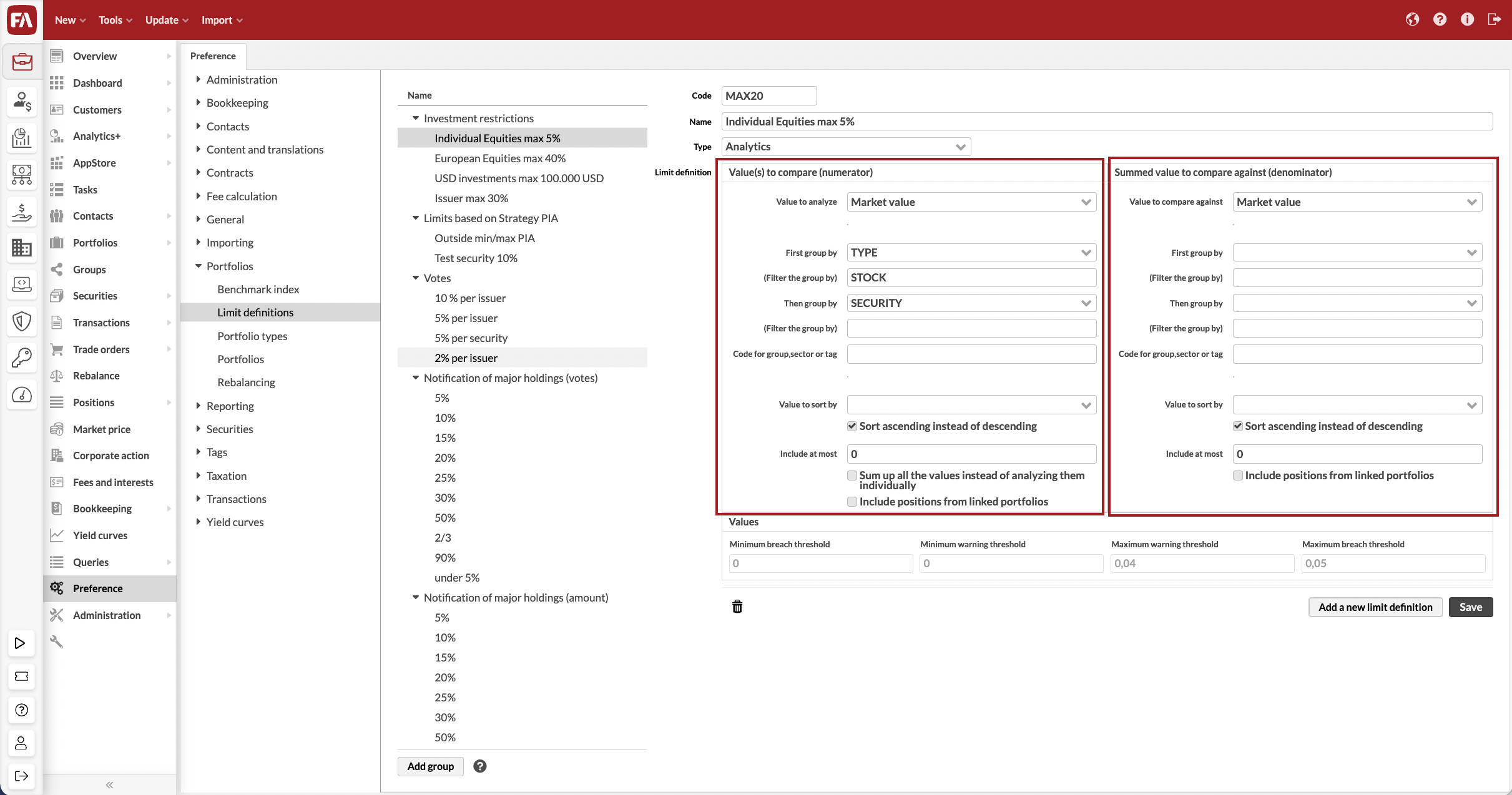

A limit definition consists of two sections: Value(s) to compare (numerator) and Summed value to compare against (denominator). These two sections allow you to set up a limit definition as relative values or absolute values:

For relative values, fill in both sections: Value(s) to compare and Summed value to compare against. For example, "total market value of stocks" (defined on the left) compared to "total market value of the portfolio" (defined on the right). As a result, your limit value will be a number from 0 to 1 ("Total market value of stocks" / "Total market value of the portfolio").

For absolute values (for example, "Total market value of Finnish stocks cannot exceed 10 000 €"), fill in only the Value(s) to compare section on the left.

You can define the values in both sections using groupings, filtering and other parameters.

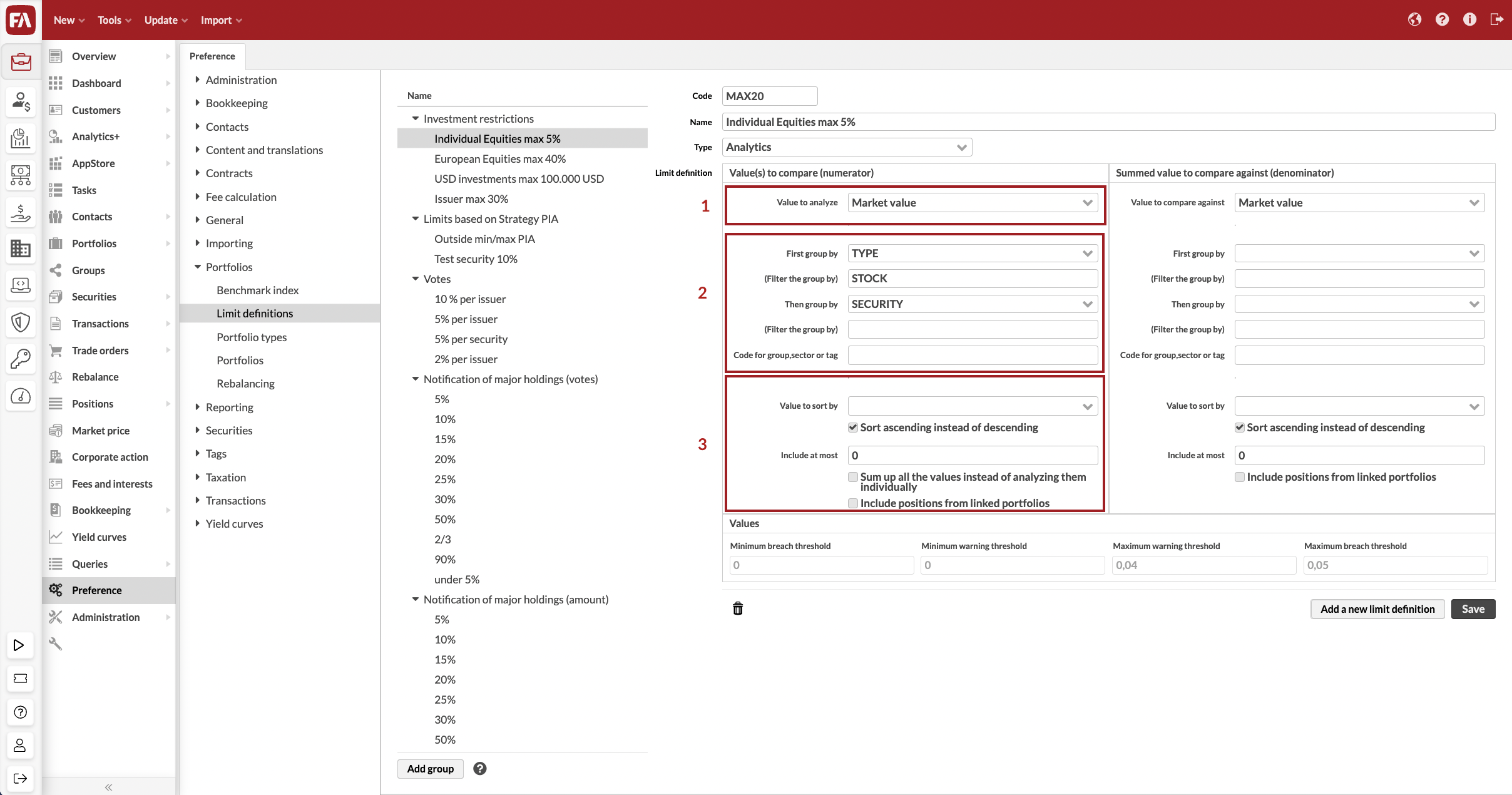

(1) Choose the value to analyze.

- Value to analyze

The one-day value (such as Market value, Amount or Exposure) you want to track. The options correspond to all columns available in Analytics+. However, it only makes sense to use values that are available for one day. For example, Market value and Exposure are available for one day, whereas TWR can't be calculated for a single day. If you are unsure, go to Analytics+ and analyze a portfolio for one day (set start date and end date the same) to see which figures make sense. You can also use your tailored Analytics+ columns and formulas as a value to analyze within your limit definitions.

(2) Use grouping and filtering to identify the component you want to analyze. If you don't use grouping and filtering, the Value to analyze is picked from the portfolio total (for example, "Portfolio's total market value"). To analyze an individual component instead (for example, "Individual stock position" or "Finnish stocks"), you can identify it with grouping and filtering.

- First group by

Identify which components/levels your limit should analyze. You can use various security-related parameters to search for the correct level, such as TYPE (Security type), CLASS1 - 5, COUNTRY, CURRENCY, or GROUP (Asset class) and SECTOR (Asset type). For example, you can set up a limit of "Individual security type should not exceed x%" by grouping with TYPE - this will analyze each security type's total value and compare it against the thresholds.

- (Filter the group by)

If you wish, define a filter to narrow down the grouping to include certain values from the group or exclude certain values from the group you identified above. For example, if you chose TYPE in First group by, you can use security type codes, such as STOCK or BOND, to include only certain types. You can find the codes in Preferences. Options for filling in the Filter the group by field:

Include one value - define one code, for example, STOCK or BOND. This allows you to pick up one value to analyze, for example, "Stocks should not exceed x%".

Include multiple values - define multiple codes as a comma-separated list, for example, STOCK, BOND. This allows you to pick up multiple values to analyze, for example, "Neither stocks or bonds should not exceed x%".

Exclude values - add an exclamation mark (!) before the code you want to exclude, for example, !STOCK or !BOND. This allows you to exclude a value from analysis, for example, "Any security type except bonds should not exceed x%".

- Then group by

If you wish, identify which components within the first group your limit should analyze. This option allows you to drill down into a portfolio to find the correct level to analyze. For example, you can set up a limit of "Individual stock position should not exceed x%" by grouping first by TYPE, filtering with STOCK, and then grouping by SECURITY. This definition analyzes and compares each stock position's value against the thresholds.

- (Filter the group by)

If you wish, define a filter to narrow down the second grouping. For example, you can set up a limit of "Stocks from Finland should not exceed x%" by grouping first by TYPE, filtering with STOCK, then grouping by COUNTRY, and filtering with FI.

- Code for group, sector or tag

If you use GROUP (Asset class), SECTOR (Asset type) or TAG in the grouping fields, select which allocation group or tag group to include. You can link multiple allocations or tag groups to your securities - if using those for limit definitions, you need to select which allocation or tag group you want to use.

GROUP (Asset class) or SECTOR (Asset type) - define the allocation you want to use with the allocation group code defined in Preferences, Preference - Securities. For example, you can define that this limit is based on ASSET allocation or GICS allocation.

TAG - define the tag group you want to use with the tag group code defined in Preference - Tags. For example, you can define that this limit is based on tags within a specific tag group.

(3) Define how the values are considered further. These fields are most useful when defining limits that depend for example on "Largest / smallest x investments", or if you want to analyze a sum of values, such as "Sum of stocks and bonds".

- Value to sort by

If you want to sort the components you found with your grouping and filtering, select the value you want to use for sorting - options available are the same as in the Value to analyze field. For example, you can set up a limit based on "Largest x investments" by grouping by SECURITY and sorting by Market value.

- Sort ascending instead of descending

Define if the above sorting is considered as ascending or descending. When enabled (default), your sorting is ascending ("Bottom investments"). When disabled, your sorting is descending ("Top investments").

- Include at most

Include only a certain number of observations, useful for limits such as "Top 10 investments" or "Bottom 5 investments". Define with a whole number how many observations you want to include.

- Sum up all the values instead of analyzing them individually

Define if the observations you identified with grouping, filtering and sorting are summed up or considered as individual items to analyze.

When disabled (default), all observations you have found with grouping and filtering are analyzed separately - if any of the observations result in a breach, your entire limit is breached. For example, you don't want to sum up values for "Any of the top 5 investments should not exceed 10%".

When enabled, all observations you have found with grouping, filtering and sorting are summed up and analyzed as one total value - only if this total value is above your breach threshold, your limit is breached. For example, you want to sum up values for "Sum of top 5 investments should not exceed 10%".

- Include positions from linked portfolios

Calculate limits based on the underlying positions from the linked portfolios.

Finally, define the minimum and maximum warning and breach thresholds.

For absolute values, define the thresholds with a numeric value in the same "unit" as your limit definition fetches. For example, you could define maximum warning threshold as "9 000" and maximum breach threshold as "10 000" for "Total market value of Finnish stocks cannot exceed 10 000 €" - you would get a warning when total market value of Finnish stocks exceeds 9 000€ and a breach when total market value of Finnish stocks exceeds 10 000€.

For relative values, define the threshold with a numeric value between 0 and 1. For example, 10% threshold is defined as 0,1. For example, you could define maximum warning threshold as "0,09" and maximum breach threshold as "0,10" for "Stock position's share in the portfolio cannot exceed 10% of portfolio's total market value". You will get a warning when the market value of any stock position exceeds 9% of the portfolio's total market value and a breach when the market value of any stock position exceeds 10% of the portfolio's total market value.

Here are some examples of limit definitions you can set up.

Absolute values

"Total market value of Finnish equities can't exceed 10 000 €."

This limit definition analyzes the total market value of securities of the type "equity" with the country "Finland".

You can modify the grouping and filtering on the left and thresholds on the right to tackle any limits of "Value of something cannot exceed a fixed threshold".

Value(s) to compare | Summed value to compare against |

|---|---|

| |

Minimum warning/breach threshold: - | Maximum warning/breach threshold: 9,000.0/10,000.0 |

Relative values

"Total value of Finnish equities cannot exceed the total value of Swedish equities."

This limit definition analyzes the total market value of securities of the type "equity" with country "Finland" and compares the result against the total market value of securities allocated as "Swedish equities".

You can modify grouping and filtering on both sides to tackle any limits of "Value of something cannot exceed the value of something else".

Value(s) to compare | Summed value to compare against |

|---|---|

|

|

Minimum warning/breach threshold: - | Maximum warning/breach threshold: 0.90/1.00 |