Contracts for difference (CFDs)

Contracts for difference - CFD’s can be handled in FA very much in similar way as Futures.

Example of CFD Security:

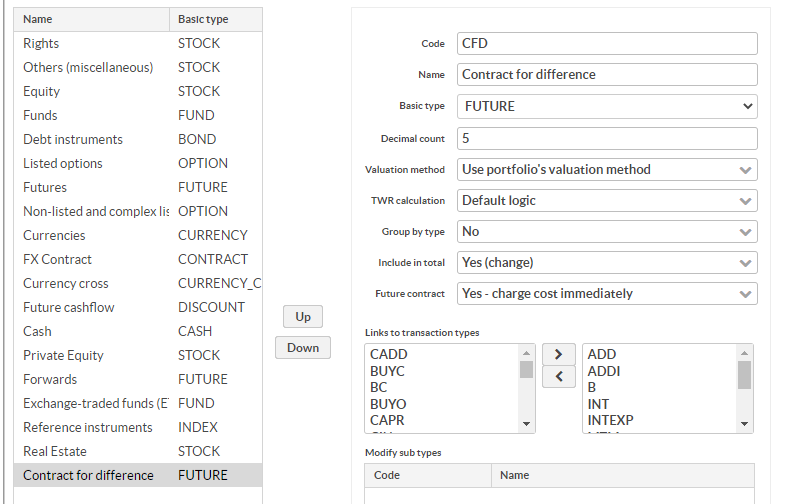

Configuration

Security type Contract for difference - CFD

You need to add the Security Type like example below in Preferences - Securities - Security types

You may use same definition as Futures security type, but you may need more decimals in some cases.

|

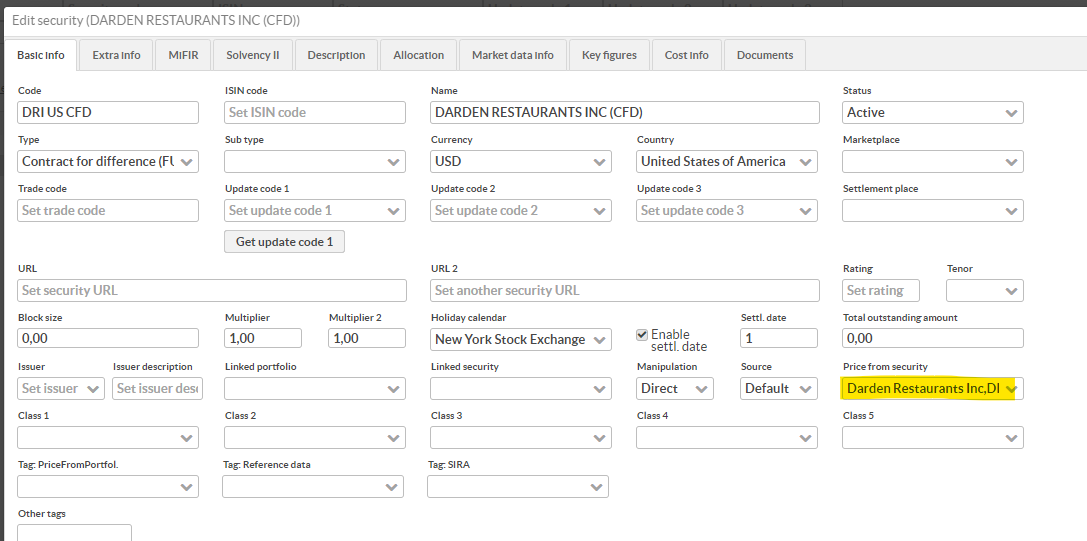

Security

You define the security similar to below.

Note that the underlying security for the CFD needs to be set up first. You have a link to that security in Priced from security field.

Note that the CFD has no maturity date, that differentiate them from Futures. Also multipliers are normally 1 as they are mostly traded in units of underlying.

Managing margin

Like futures you have a margin account in Portfolios in the currency of the CFD. Daily Mark to Market transactions are booked towards that account using same procedure as for Futures Futures with margin accounts .

Also initial margin needs to be booked towards a collateral account. This is the collateral amount that the custodian require for entering the transaction. That is often a percentage of the underlying value.

Financing cost

On CFD transactions it is a daily accrued financing cost is calculated for open positions based on the opening cost, i.e. the underlying value at opening transaction. This can actually be both a cost or gain, depending if short or long position and if interest rate is positive or negative.

The query below gives daily accrued financing cost that is needed to book on accrual account.

You give in parameters: portfolio, CFD Security, Interest rate (decimal point) and Day basis (360 or 365).

select i.market_date,i.orig_trade_amount,ROUND(($P(Rate)/100)*i.orig_trade_amount/$P(DayBasis),2) as 'Accrued Financing Cost'frompm2_pf_rep_item iwherei.pf_id in $P(portfolioId) and i.security = $P(securityId)

On a monthly basis the custodian capitalize the accrued financing cost toward cash account. This capitalization can be booked according to some specification from the custodian. If you have booked the daily accrual of financing cost, the amount charged the cash account and should zero out the balance on the accrued financing cost account.