Standard Solution February 2023 - Release notes

Released: February 28th, 2023

Standard solution February 2023 enables you to export holdings in MT535-format, tag inactive portfolios. It introduces a new private equity transaction type, and improved FA-to-FA synchronization, along with many other new features and improvements.

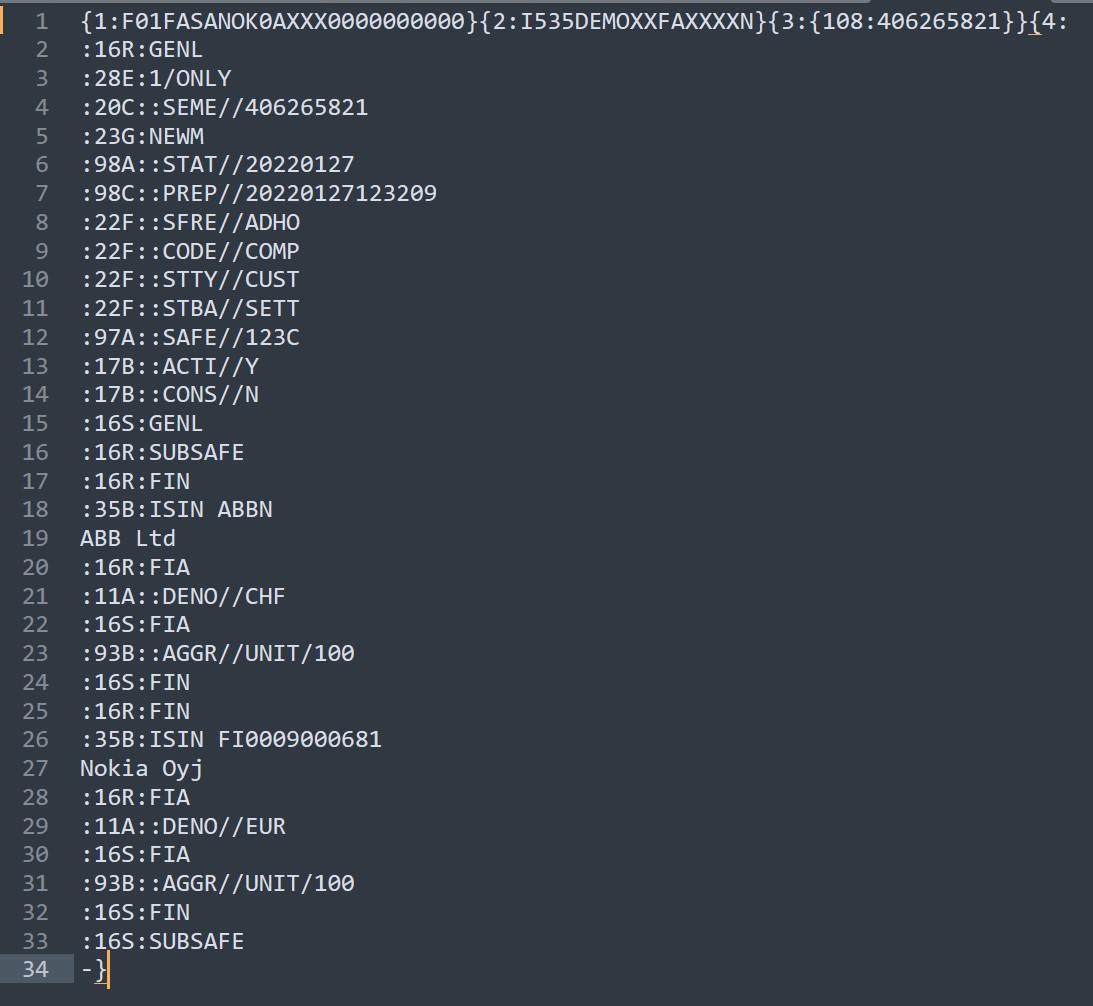

MT535 Statement of holding export

Why?

This development was done because some clients need to export positions from FA in MT535-format to a third-party system for reconciliation purposes.

Who is this for?

This feature is for everyone needing to export positions from FA in the MT535 format to a third-party system for reconciliation. Normally, positions in FA are reconciled against the custodian, and then FA is the receiver of the reconciliation material, but there could be cases when it is the other way around. For example, some mutual fund companies use distributors and need to send reconciliation material to the distributors.

Details

Already earlier, you could produce reconciliation files in FA format, but naturally, all third-party systems don't accept FA format. MT535 messages are ISO-standardized files used to report, at a specified moment in time, the quantity and identification of financial instruments which the account servicer maintains for the account owner.

From this version of Standard Solution, the MT535 export is available as two optional reports to install. One is transaction date-based, and the other one is settlement date-based. If a report is generated for multiple portfolios, the output MT535 file contains one message per portfolio. Each message gets a unique header and reference.

|

Learn more: Export positions from FA in FA User Guide.

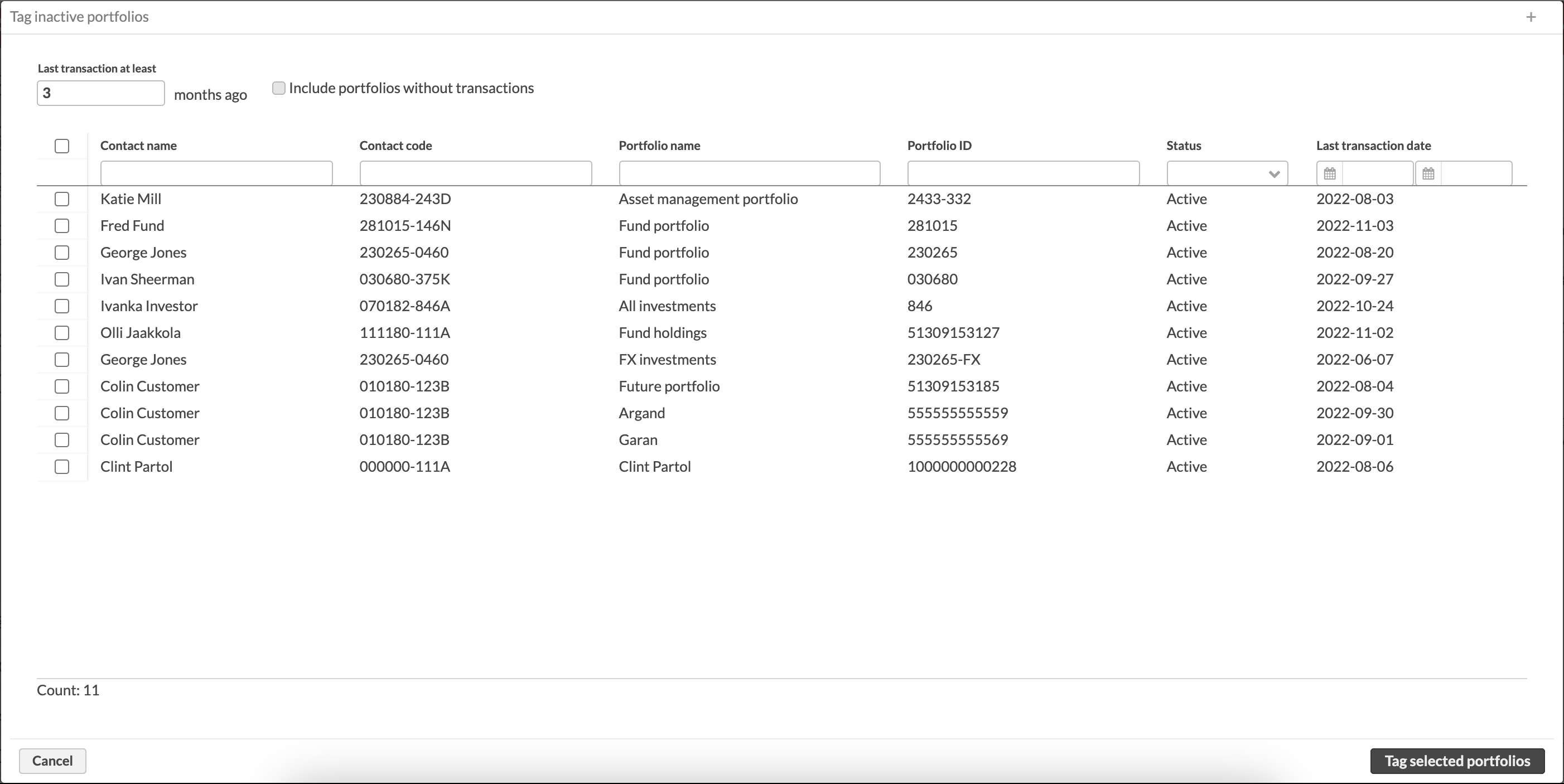

Tagging of inactive portfolios

Why?

We introduced this feature because there was a compliance need to monitor portfolios that have not had holdings or transactions for a certain period of time.

Who is this for?

This feature is for users (for example, compliance) who want to monitor portfolios that didn't have holdings or transactions for a certain period of time, and to take action based on that information.

Details

You can manually or automatically tag portfolios that didn't have holdings or transactions for a certain period of time (for example, for 6 months). The idea is to avoid having portfolios that are not used after the customer relationship becomes obsolete. If a customer didn't have holdings or transactions in the last 6 months or longer, the portfolio can be tagged automatically or manually by running the process. You can use the tag to filter out the portfolios and call the clients or take any other action. For example, you can automatically set the portfolios to status Closed using a decision table that reacts to the tag set on the portfolio.

When you run the process manually, you get a list portfolios that didn't have holdings or transactions for 6 months (or another configurable time period). You can choose which portfolios to tag. For new portfolios (which don't have any transactions yet), there is the Include portfolios without transactions checkbox at the top.

|

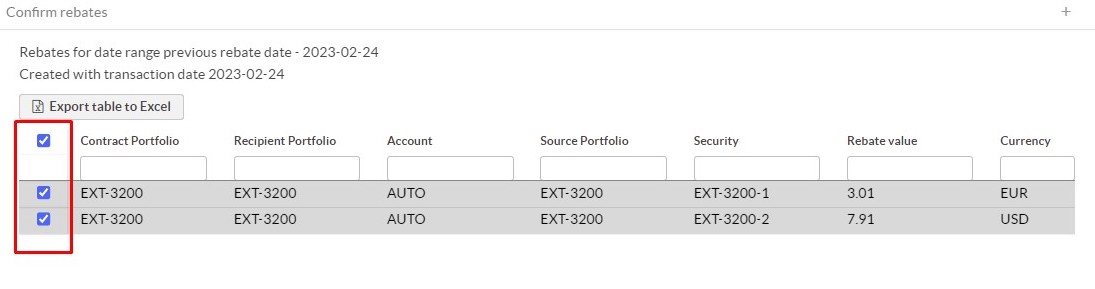

Improved rebate contracts process

Why?

We introduced this feature to provide a way to filter which rebate transactions should be created.

Who is this for?

This feature is useful for everyone who calculates rebates or kickbacks and needs to prevent certain rebate transactions to be created.

Details

When calculating rebates with the Rebate contracts process, you can select in the preview which transactions to create. This comes in handy if you, for example, calculate rebates for different securities that have different capitalization frequencies in the same portfolio. If you have EUR and USD securities in the same portfolio, and EUR securities are capitalized quarterly and USD monthly, you can now exclude the EUR securities when calculating rebates for the USD securities.

|

Learn more: Handle contract rebates (kickbacks) in FA User Guide.

New Private equity - Return of call transaction type

Why?

We implemented this feature because a new standard transaction type for private equity investments was needed.

Who is this for?

The Return of call transaction type is useful when a private equity company calls too much money from the investor and then returns the extra money back.

Details

The new transaction type is called "PE - Return of call" and has the same transaction type effects as "PE - Call", but the opposite way. This transaction type is similar to all PE transaction types linked to the Private equity security type.

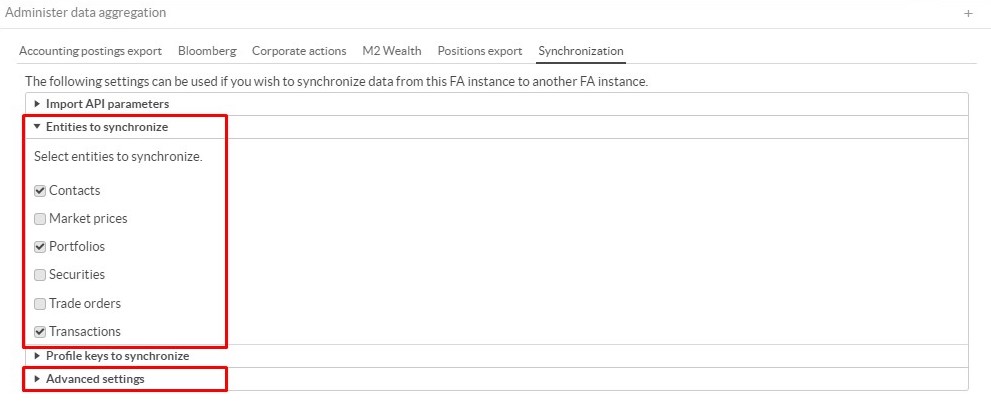

Improved FA-to-FA synchronization

Why?

We improved FA-to-FA synchronization by adding an option to choose what data to synchronize.

Who is this for?

This feature is useful if you use FA-to-FA synchronization to transfer data between two FA instances and to update the data when there are changes.

Details

FA-to-FA synchronization was added to Standard Solution some time ago, and now we made this functionality more configurable. You can choose which entities to synchronize: Contacts, Market prices, Portfolios, Securities, Trade orders, and Transactions.

An advanced setting lets you specify more granularly which importer keys you want to include in or exclude from synchronization. For example, if you need to synchronize all entities, but not the portfolio groups (because the groups in the two environments aren't the same and it would result in errors), you can specify p.portfolioGroups in the list of keys to exclude. The list of keys is comma-separated.

|

Learn more: Set up FA-to-FA synchronization in FA User Guide.

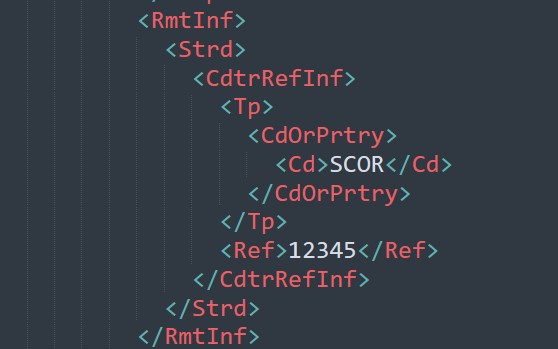

Domestic reference in payments

Why?

This feature was developed to populate Domestic reference in Pain.001 SEPA payment files.

Who is this for?

This feature is for users who send Pain.001 payment files to Nordea or SEB Finland and want to use domestic reference. Domestic reference is a unique reference number from the end customer which is populated into the technical Pain.001 XML-file. One reason for using the domestic reference is that it is sometimes cheaper to send payments with a domestic reference than without it.

Details

Domestic reference is populated in the file if Creditor reference=reference here is added to the transaction's Internal info field.

|

Learn more: Set up payment instructions in FA Admin Guide.

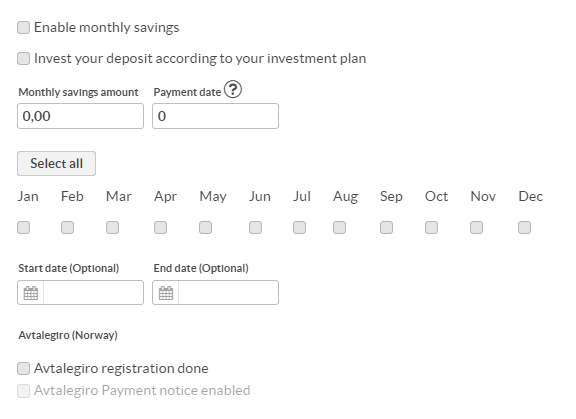

Usability improvements in the Monthly savings window

Why?

We implemented changes to make the settings for monthly savings easier to use.

Who is this for?

This improvement is for those who administer Monthly savings in FA Back for end clients.

Details

The biggest usability improvement is that the month selection now has a "Select/Unselect all" button so that you don't need to click all months one by one. Some fields are also rearranged: we removed a field that was no longer used, moved optional fields, such as Start date and End date down, and placed Avtalegiro-related fields at the bottom of the window.

|

Learn more: Monthly savings in FA User Guide.

Other improvements

The Drift monitoring and Drift tracker processes are used to track portfolio drift from investment plan or strategy. The processes now support parent-sub portfolio structures. The process takes sub-portfolios into account if run against a parent portfolio with linked sub-portfolios.

New standard transaction cost types and transaction types for FX-hedged share classes are added. Now there are standard transaction cost types, for Advisory fee, Custodian fee, Commission, Subscription/Redemptions fee, and so on. Also, transaction types needed if you are running a mutual fund with FX-hedged share classes are now pre-installed.

Transaction types used for individual performance fees with contingent redemption method are added. These types are used for compensation orders when you use Performance fee equalization and NAV (without performance fee) is smaller/greater than HWM at the time of the subscription/redemption.

Additional tagging is added to Contact/Portfolio (whichever the document is stored under) when a document is automatically sent for signing with Send documents to Signicat process, and for some reason fails. For example, if the social security number is incorrect, the Contact/Portfolio gets

Document signing-Errortag, and the user or a decision table can react to that. Learn more: Document signing in FA User Guide.Yield To Maturity, Duration, Modified duration, and Convexity are now fetched from Bloomberg if you use FA's Bloomberg security reference data integration. They are imported as security Key figures in FA and the imported key figures override FA´s calculation.

ISIN code used in MiFIR reporting is now fetched from ISIN field in the security MiFIR profile tab if set. If not set, it uses ISIN from the security Basic info tab.

When new Futures securities are created in FA using M2 Wealth integration, contract size and expiration date are now also imported if available in the files received from M2.

Create cash transactions process is updated to work with the new "PE - Return of call" transaction type (described above). The process is used to automate the deposit and withdrawal transaction generation to fund portfolios after trade orders on the fund are executed.

Fixes

Portfolio Management

Users with the GRO user role now have access to the Groups view to see and manage portfolio groups. Previously, GRO role was missing the needed permission, and the users couldn't see and manage portfolio groups.

Removed invalid and incomplete Finnish translations.

External reporting

Pre-defined CFI-code tags are added for the SEB custody reporting. A decision table automatically adds the tags to the securities based on the security type. Previously pre-defined CFI-code tags were missing and there was no automatic way to set needed tags.

In SIRA/PEF reporting, capital flows are now always grouped together per share class, regardless of what's selected on the share class profile. Previously the SIRA/PEF report didn´t group capital flows together unless the "Aggregate holdings on this share class" selection was selected in the SIRA/PEF profile of the share class security.

SIRA contact profile no longer shows wrong sector codes in some scenarios.

Compliance

Limit-related queries used in dashboard are now shared with relevant user roles. Previously they were not visible for relevant user roles.

Fee Management

Fixed an issue in Rebate contracts process when run for a portfolio with securities that have other currencies than the portfolio currency. Previously, in this specific scenario the process created rebate transactions with incorrect FX-rate.

Settlements

Fixed an issue with Settlement routes that were previously unable to start.

Tax reporting

Fixed an issue in Norwegian tax reporting where inconsistent values were picked up in tax XML file when reporting dividends in ETF.

Acquisition value is now reported correctly in Norwegian tax Verdipapirfond report when a lot is "realized" with a Remove transaction.

Accrued interest is now part of the "kapitalunderlag" in Swedish KU30 tax report. Previously, accrued interest was excluded from the calculation.

Payments

General outgoing payments process now stops the creation of payment material if the process is not yet fully compiled/loaded after, for example, a system restart. Previously, in these situations it could look like a payment file was created, but it was actually not.

Utilities

Removed unnecessary logs that could mislead the users and make them think something is wrong, while in practice it is not.

Reconciliation

Reconciliation - Bank Statement report is now significantly faster due to improvements made in the underlying Accounts API used by the report.

It is now possible to reconcile multiple accounts with the same account number across multiple portfolios.