FX Swap

Contract type FX Swap is an agreement between two parties to exchange currency between two parties, in which they swap holdings in one currency for a holding in another currency for a fixed period of time.

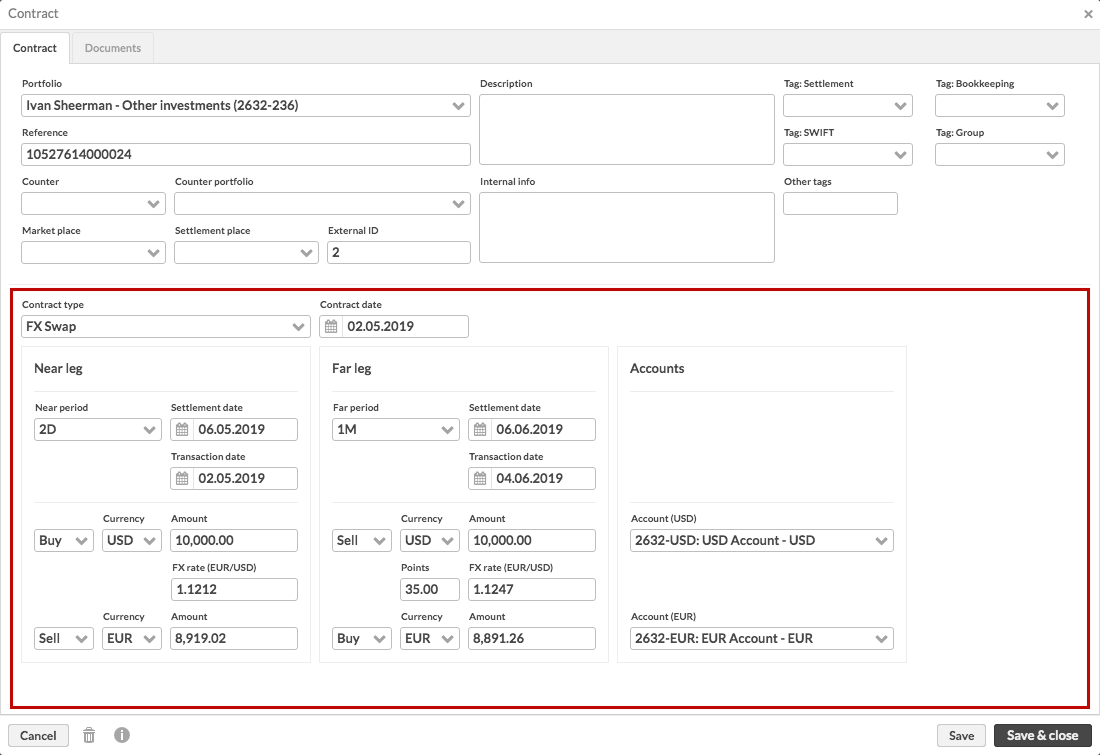

For FX Swap, the contract-specific fields allow you to fill in information that is relevant for entering an FX Swap contract into the system. You can fill in the information of the near leg and the far leg of your FX Swap in the same window - the fields allow you to manage both spot-forward swaps as well as forward-forward swaps.

The fields available are:

- Contract date

Date when the contract beings. For FX Swap, the near leg cashflows occur on the contract date (if the near leg is a spot), and the far leg the forward cashflow positions appear in your portfolio on the contract date.

Near leg and Far leg sections allow you to define all relevant details of the swap. You can define your swap in terms of the two cashflows you would be exchanging once in the beginning (near leg) and then back in the end (far leg) - information relevant to each cashflow is shown on the same row.

Near leg section allows you to define all relevant details for the beginning of the swap. The near leg of your swap can be either a spot or a forward, and the near leg fields are the same as the contract-specific fields for FX Forward with the following special characters:

Near leg type - select the type of the near leg as an FX Spot or an FX Forward (available from FA 3.10 onward). For contracts created prior to FA 3.10, the system interprets your near leg's type based on its length: if the leg's settlement date is two days or less after the contract date (taking into account the involved currencies' holiday calendars), the near leg is an FX Spot, otherwise the near leg is an FX Forward.

Near period - select the length of the near leg of your swap. The near period is used to calculate the settlement date of the near leg cashflows.

By default, the near leg is assumed to be a spot, and the near period is pre-filled to be 2D. When the near period is a spot, the settlement date is calculated as in contract-specific fields for FX Spots (settlement date = contract date + 2D), and transaction date is the same as the contract date.

In case the near leg is a forward, you can change the length of the near leg to be something else, for example 1W or 1M. When the near leg is a forward, the settlement date and transaction date are calculated as in contract-specific fields for FX Forwards (settlement date = contract date + 2D + near period).

Far leg section allows you to define all relevant details for the end of the swap. The far leg of your swap is always a forward, and the buy / sell selections should be opposite to your near leg, the currency selections the same as in your near leg, and the first cashflows amount the same as in your near leg. When you change these values in either of the legs, the other leg is changed accordingly. The far leg fields are similar to the contract-specific fields for FX Forward with the following special characters:

- Far leg type

Shows the type of the far leg, which is always FX Forward (available from FA 3.10 onward). Far period - select the length of the far leg of your swap. The far period is used to calculate the settlement date of the far leg cashflows by adding the selected period into the near leg settlement date (far leg settlement date = near leg settlement date + period). Otherwise, setting the settlement date and transaction date work as in contract-specific fields for FX Forwards.

- Buy / Sell

Pre-filled to be opposite to the buy / sell selection you made in the near leg for the same cashflow (on the same row). Determines the direction of the far leg cashflow, i.e. if you "buy" in your near leg, then you "sell" in your far leg. If you change this selection, the near leg buy / sell selection is changed accordingly. Currency - pre-filled to be the same as the currency you selected in the near leg for the same cashflow (on the same row). The currencies have to be the same for the same cashflow for near leg and far leg - you are exchanging the currencies back and forth. If you change this currency, the near leg currency is changed accordingly.

- Amount

Pre-filled to be the same as the amount you defined in the near leg for the same cashflow (on the same row). One of the amounts you are exchanging in the beginning has to be the same as you are exchanging at the end. If you change this amount, the near leg amount for the same cashflow is updated accordingly.

- Points

Allows you to define how much the far leg FX rate changes compared to the near leg FX rate. A point is the smallest amount a price can move in a currency quote, and 1 point = 0.0001 change in far leg FX rate from the near leg FX rate. Points are used to calculate the far leg FX rate as near leg FX rate + points/10 000 = far leg FX rate. For example, 1.1464 + 10 points = 1.1464 + 0.001 = 1.1474

- FX rate (currency cross)

Pre-filled based on the points you entered. The far FX rate is the price you agreed to do the exchange between the two currencies you selected. The FX rate is used to convert the amount you have entered on the upper row to the amount on the lower row, and the caption of the field indicates the currency cross you should fill in.

- Sell / Buy

Pre-filled to be opposite to the buy / sell selection you made above and opposite to the Buy / Sell selection you made in the near leg for the same cashflow (on the same row). If you change this selection, the above buy / sell selection and the near leg buy / sell selection is changed accordingly.

- Currency

Pre-filled to be the same as the currency you selected in the near leg for the same cashflow (on the same row). The currencies have to be the same for the same cashflow for near leg and far leg - you are exchanging the currencies back and forth. If you change this currency, the near leg currency is changed accordingly.

- Amount

Pre-filled based on the amount you entered on the upper row and the FX rate you defined. If you update this amount, the system automatically calculates the FX rate to ensure all calculations match.

Accounts section allows you to define the accounts affected for the dates defined on the near leg and the far leg, i.e. which accounts the buy and sell cashflows are directed to in the beginning and in the end of the contract.

- Account (Currency)

Select the account you want to direct the cashflow in the selected currency to. The account selections always correspond to the cashflow you have defined on the same row on the left, and the caption of the account field indicates which currency cashflow you should select the account for. The dropdown lists accounts in the selected currency within your selected portfolio, and the account filed is pre-filled if your selected portfolio only has one account in the selected currency.

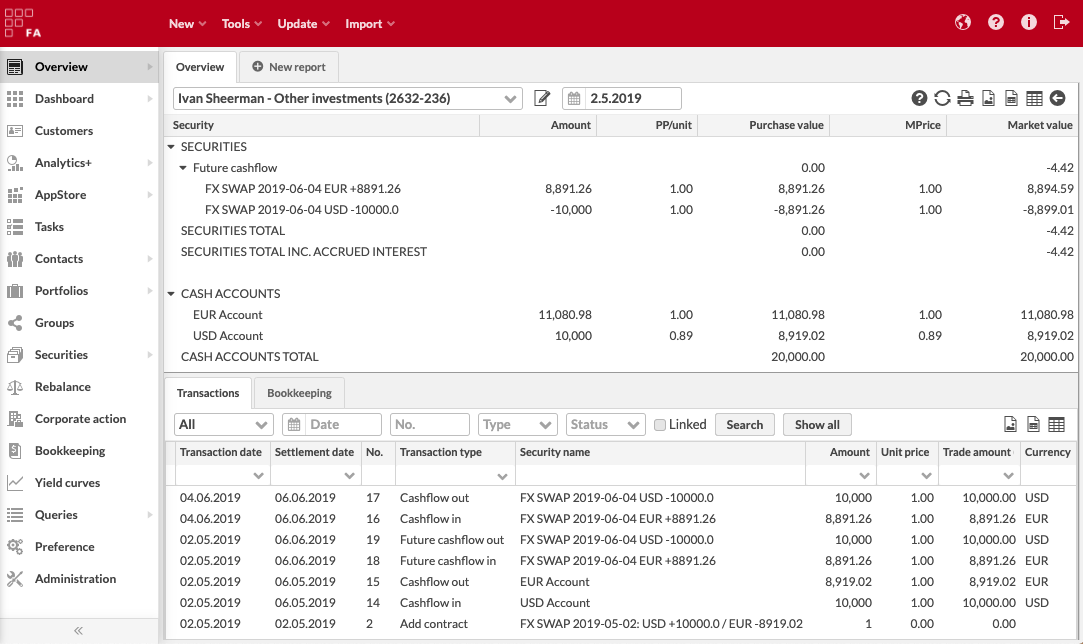

When saving an FX Swap, the system creates a contract security, generates relevant cashflows in the beginning of the contract, produces forward cashflow positions into your portfolio between the contract date and the end of the contract, and generates relevant cashflow transaction for the end of the contract.

Component | FX Swap specific details |

|---|---|

Contract security | Naming of the FX Swap security: Syntax: FX SWAP [near leg date yyyy-MM-dd]: [near leg first cashflow's Currency] [+ for Buy / - for Sell] [near leg first cashflow's Amount] / [near leg second cashflow's Currency] [+ for Buy / - for Sell] [near leg second cashflow's Amount] ([near leg FX rate]) / [far leg date yyyy-MM-dd]: [far leg first cashflow's Currency] [+ for Buy / - for Sell] [far leg first cashflow's Amount] / [far leg second cashflow's Currency] [+ for Buy / - for Sell] [far leg second cashflow's Amount] ([far leg FX rate]) "Date" used in the contract name depends on your selection in contract preferences - date is set either based on the contract date (=transaction date) or settlement date of your FX Swap (available from FA 3.7 onward). Example: FX SWAP 2019-05-06: USD +10000.0 / EUR -8919.02 (1.1212) / 2019-06-06: USD -10000.0 / EUR +8891.26 (1.1247) |

Near leg forward cashflows | FX Swap induces two near leg forward cashflows ONLY IF the near leg is a forward. If the near leg is a spot (i.e. near period is 2D), no forward cashflows are induced for the near leg. If the near leg is a forward, forward cashflows are generated the same way as for FX Forwards. |

Near leg cashflows | FX Swap induces two cashflow transactions at the end of the near leg.

|

Far leg forward cashflows | FX Swap induces two far leg forward cashflows, generated the same way as for FX Forwards. |

Far leg cashflows | FX Swap induces two far leg cashflow transactions, generated the same way as for FX Forwards. |