Use latest market prices in rebalancing

When calculating how much to buy or sell, rebalancing always uses the latest available market prices in relation to the selected rebalancing date. By default, the latest market price entries (and relevant fx rates for converting prices to portfolio currency) are fetched from FA. Note that your market unit price might be larger than the difference you need to cover!

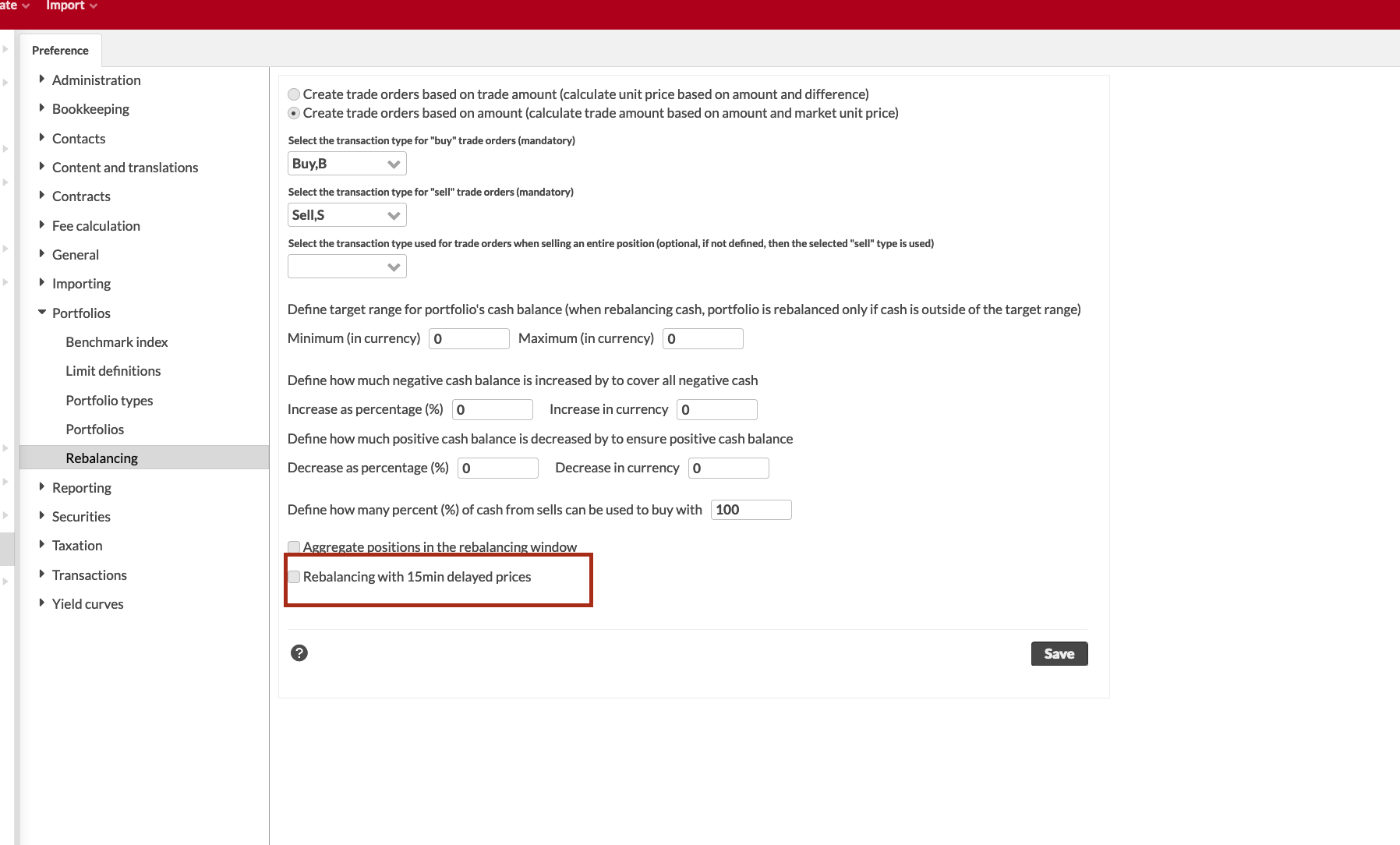

However, you can also enable rebalancing with real-time 15 minutes delayed prices, fetched with a corresponding Market Price Connector from SIX, to get more up-to-date results from rebalancing your portfolios. You can enable this in rebalancing Preferences - when enabled, every time you trigger a rebalance on your portfolio(s), the market price connector fetches the latest available prices for all your positions' securities directly from SIX, and uses the prices when calculating your trade orders. NOTE that rebalancing will always use the latest available price it can find - if you the connector to SIX is not enabled, or if you for some reason don't get a price through the connector for a security, then the latest available price stored in FA is used. Also, prices fetched from SIX are converted to portfolio currency with latest FX rates stored in FA when necessary.

The latest available market price is also set to the trade order, depending on whether you have selected to calculate your trade orders based on amount.