Preference - Taxation

Taxation preferences include relevant preferences for defining tax types and default tax rates.

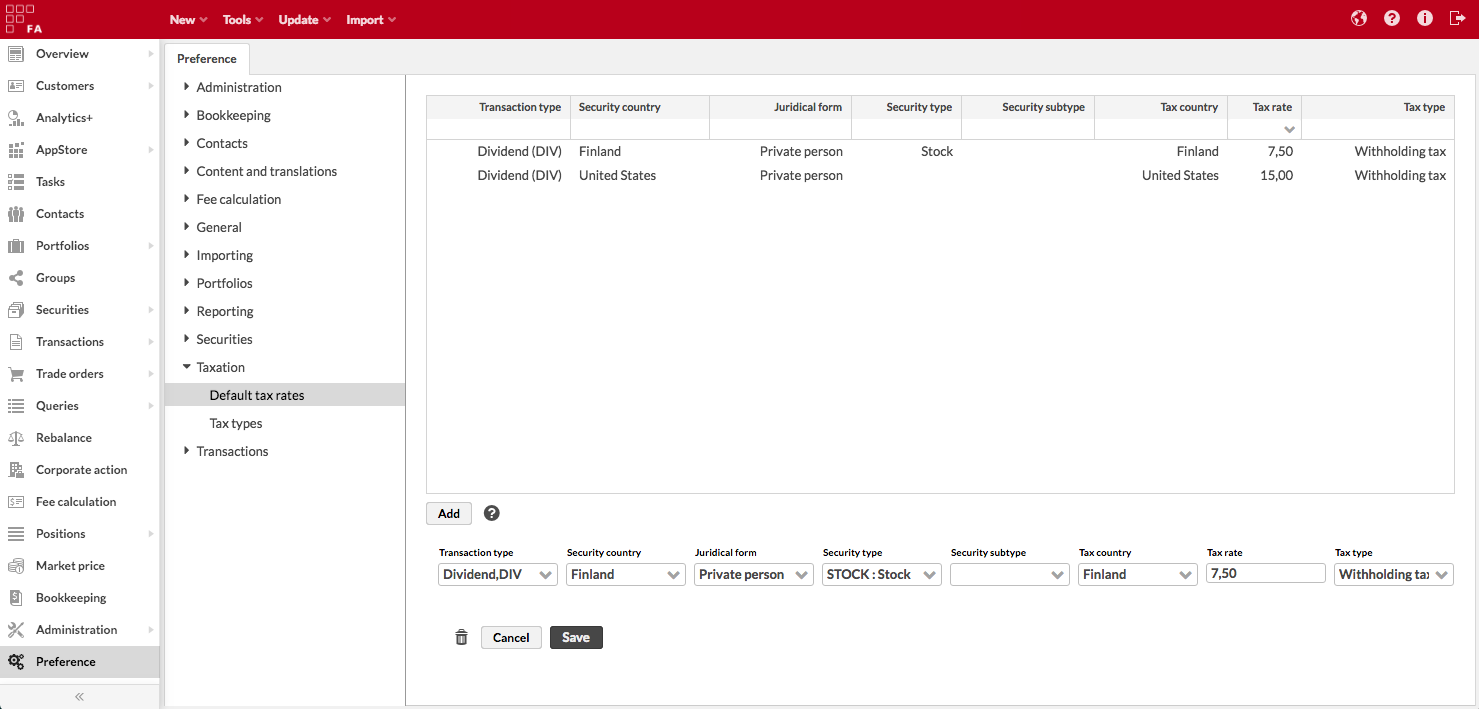

Default tax rates

Default tax rates are used for automatically filling in the tax information when running corporate actions or calculating the taxes when adding transactions. In the Default tax rate preferences you can define the default tax rates for different combinations of the transaction's type, security's country and type, and portfolio's juridical form and tax country: Default tax rates can be defined for the combinations of these criteria, and the default tax rate is used only when all defined criteria are met.

For example, you can define a default tax rate of a 7.5% withholding tax calculated for all dividends on Finnish stocks recorded to the portfolios owned by private persons in Finland.

The existing default tax rates can be searched by defining the search criteria on the search fields at the top of the window. Default tax rates can be searched with either one or more search criteria and the Show all button shows all default tax rates defined in the system. The default tax rates can be viewed and modified by choosing a default tax rate from the listing. The Delete button deletes the chosen default tax rates and the OK button saves the changes made.

A new default tax rate is added with the Add button below the default tax type listing. The default tax rate information is defined in the fields below the default tax rate listing: the first fields are used to define the combination the default tax rate is used for, and the last two fields are used to define the contents of the default tax rate. A red star indicates that a field is mandatory.

- Transaction type*

The transaction type this default tax rate is used for (e.g. buy, sell, dividend).

- Security country*

The security's country this default tax rate is used for.

- Juridical form*

The portfolio's juridical forms this default tax rate is used for.

- Tax country

The portfolio tax country this default tax rate is used for.

- Security type

The security type this default tax rate is used for (if no security type is chosen, the default tax type is used for all types of securities when other conditions are met).

- Security subtype

The security's subtype this default tax rate is used for (if no security subtype is chosen, the default tax type is used for all types of securities when other conditions are met).

- Tax rate

Define the tax rate used by default for the combination of the criteria selected from the previous fields.

- Tax type

Define the tax type, defined in Preference - Tax types, of the default tax rate.

The default tax rate is saved with the OK button below the fields.

Tax types

Tax types are used for determining the type of a tax recorded to a transaction: the transaction window has two fields for recording a tax to the transaction, and the tax types defined in preferences can used to identify and categorize these taxes recorded to transactions. Tax types are also used in defining default tax rates for running corporate actions. For example, a tax type can be capital gains tax or VAT.

Tax types can be defined in the Tax types window in Preference. The existing tax types are listed on the left-hand side of the window. The tax types can be viewed and modified by choosing them from the listing. The Delete button deletes the chosen tax type and the OK button saves the changes made.

A new tax type is added with the Add tax type button. The tax type information is defined in the fields on the right-hand side of the window. A red star indicates that a field is mandatory.

- Code*

The individual tax type code that separates it from other tax types.

- Name*

The name of the tax type. The name of the tax type is shown in the Transaction window.

- Profit

The selection tells whether the tax type has a profit effect. The profit effect indicates whether the amount of this type of tax will have an effect on the portfolio's profit and whether the amount of this type of tax will be included in the position's purchase value. By default, the profit effect is not selected, and the tax will not have an effect on the portfolio's profit or will not be included in the portfolio's purchase value.

- Cash

The selection tells whether the tax type has a cash effect. The cash effect determines whether this type of tax has an effect on the portfolio's cash, i.e. is the amount of the tax deposited to or withdrawn from the portfolio's account with the transaction. By default, the cash effect is selected, and the tax has the same effect on the portfolio's account as the transaction does. If not selected, only the net price of the transaction without the tax of this type would affect the portfolio's cash.

The tax type is saved with the OK button below the fields.