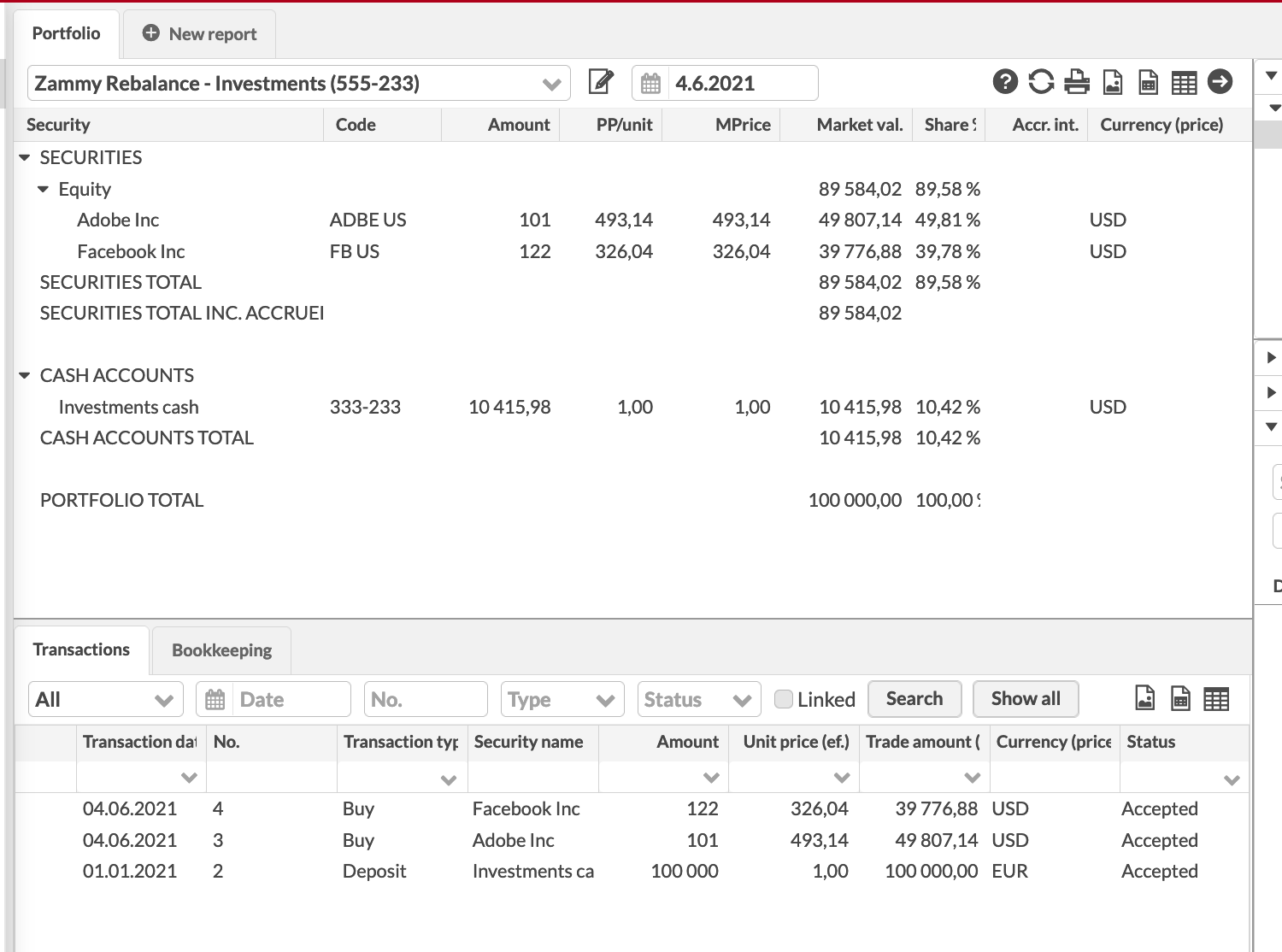

Rebalance portfolios against the investment plan

In FA, you can also define investment plans to your portfolios and use these to keep your investment portfolios in balance through rebalancing the investment portfolios against an investment plan. In addition, FA supports rebalancing portfolios against a model portfolio, which is especially useful for discretionary asset management - see more details through here.

Follow the steps below to set up investment plans to your portfolios (step 1) and to rebalance your investment portfolios against their investment plans (steps 2 and 3).

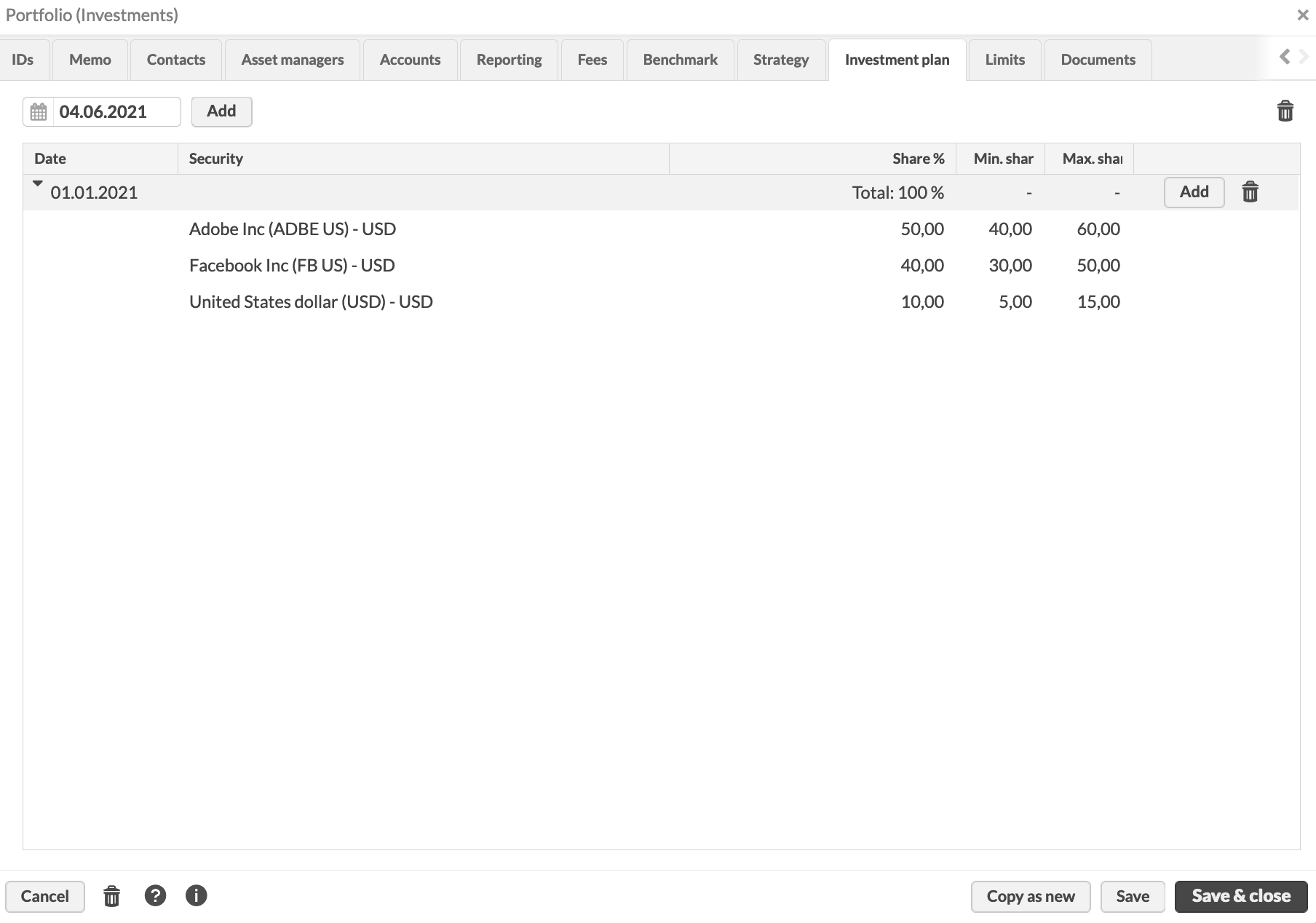

Step 1 - Define investment plan(s) for your portfolio(s)

The first step in rebalancing portfolios against their investment plan is to define appropriate investment plans for your portfolios: an investment plan consists of securities and their shares you want your portfolio to consist of. Before starting to create investment plans, make sure you have created all the securities you want to include in your plans as securities in FA.

Investment plans are defined per portfolio in the Portfolio window: open the portfolio you want to define an investment plan to and select the Investment plan tab. Set the date from which the investment plan is valid from and define the securities the investment plan consists of and the shares of these securities of the investment plan total. If you want to change the contents of the investment plan, add a new date with new securities and shares.

Step 2 - Rebalance your investment portfolios in order to get trade orders to buy or sell to match your investment portfolios to their investment plans

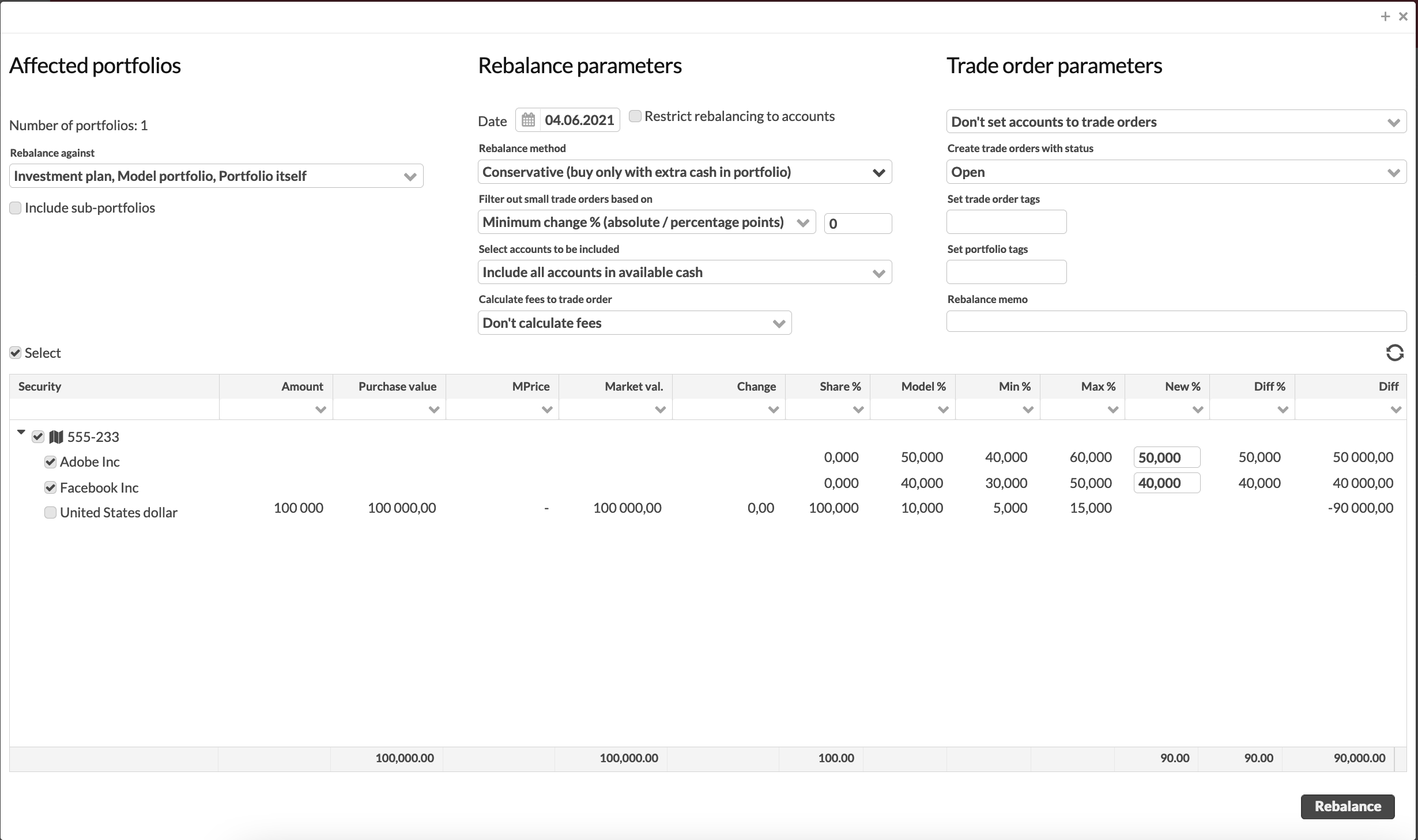

Once you have set up an investment plan in step 1, you can rebalance your investment portfolios, or to use the rebalancing functionality to create trade orders to buy and sell securities for your investment portfolios.

There are different ways to rebalance investment portfolio(s). You can either

a) Rebalance a single portfolio through the Overview. Select your investment portfolio on the Overview, and right-click it under the Selected portfolios section on the right. From the menu available, choose Rebalancing.

b) Rebalance selected portfolios against the investment plan defined for each through the Portfolios view. Search the portfolios you want to rebalance on the Portfolios view (use quick searches, filtering or saved searches to search for the portfolios you want to rebalance), and click Rebalance at the bottom of the view and select one of the options including Investment plan. This option allows you to simultaneously rebalance multiple investment portfolios even with different model portfolios linked to each.

In all cases, after having initiated rebalancing, the rebalancing process goes through the same steps within the Rebalance window. To rebalance your investment portfolios

Define the rebalancing parameters in the rebalance window by making appropriate selections for affected portfolios, rebalancing parameters and trade order parameters. In addition, you can manually adjust the new share percentages of each security fetched from the model portfolio.

Click Rebalance in order for the system to rebalance you investment portfolio(s) and suggest trade orders. The trade orders to be created is determined by the rebalancing logic.

If necessary, restrict the list of suggested trade orders. Restricting the trade orders allows you to only create some of the suggested trade orders: utilise the search fields to search for trade orders within the suggestion, or filter the trade orders shown with the columns available to restrict the trade orders to be saved.

Save the trade orders visible in the trade orders window. Note that only the trade orders visible will be saved as trade orders to the portfolio - if you want to save all suggested trade orders, clear all filters and search criteria before saving.

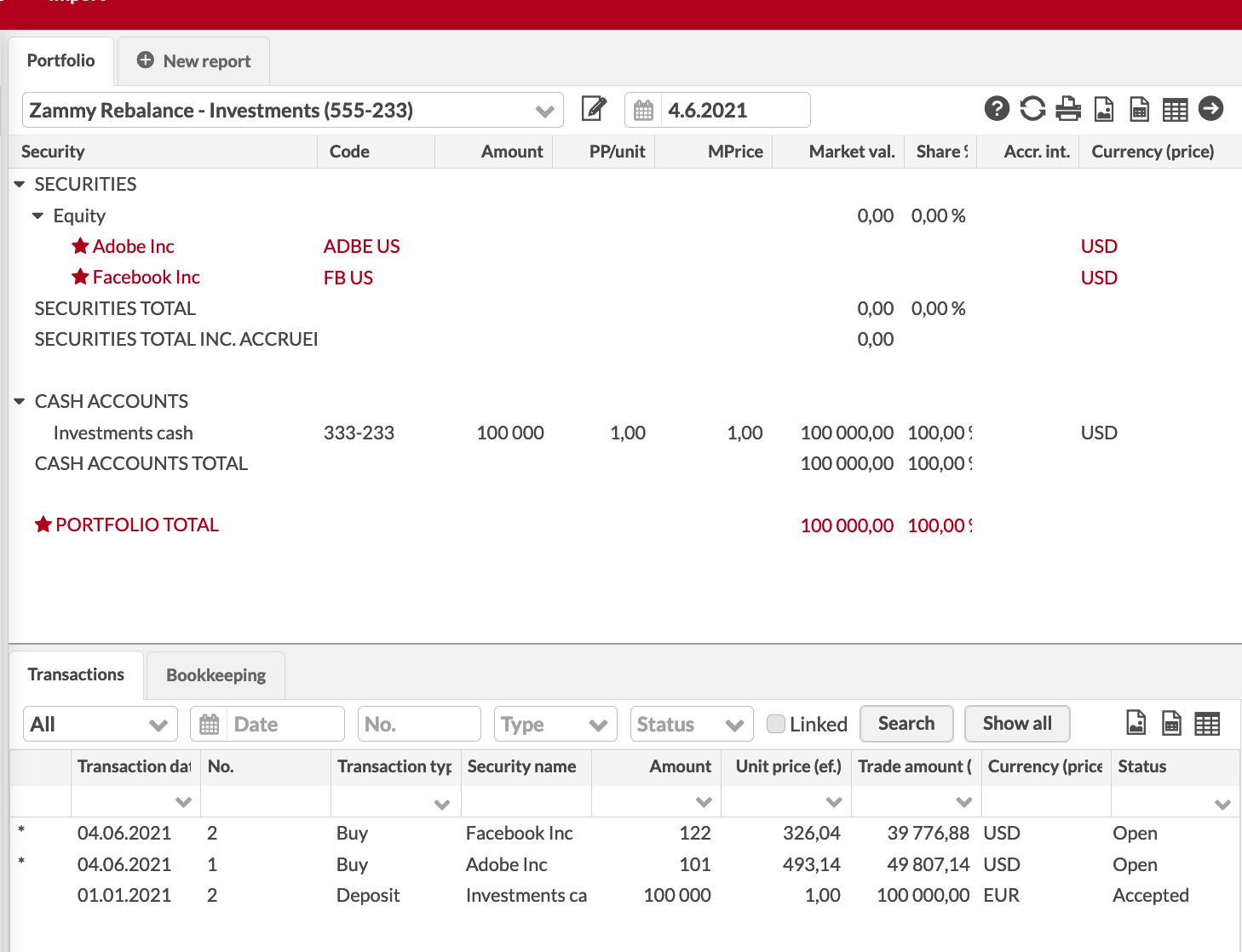

Step 3 - Execute the trade orders in order to create transactions in your investment portfolios

After rebalancing an investment portfolio against an investment plan, trade orders to buy and sell securities are created to the investment portfolio. In order to fully rebalance an investment portfolio and to match its contents to the investment plan, the trade orders should to be executed in order for them to have an effect on the contents of the investment portfolio.

To execute trade orders

Search for the created trade orders in the Trade orders view and set their status to be Executable. Send the executable trade orders forward, and buy and sell securities to your investment portfolio(s) based on the suggested trade orders.

Once the trades have been implemented in the market, execute trade orders in FA with the realized values in order to create transactions to your investment portfolios.