FA Back 3.18 - Release notes

Released: April 2023

FA Back 3.18 provides you with the possibility to import data with more special characters than before, add receive date and time to your trade orders and transactions, a more flexible way of marking representatives and several improvements to Analytics+.

Importing to support more special characters

Why?

We implemented this feature to avoid situations where special characters are not correctly displayed after import.

Who is this for?

For users who use characteristics in their alphabet that are not supported by Windows-1252 encoding, e.g. Latvian language and for users who use other operating systems than windows and need the Scandinavian letters ÅÄÖ.

Details

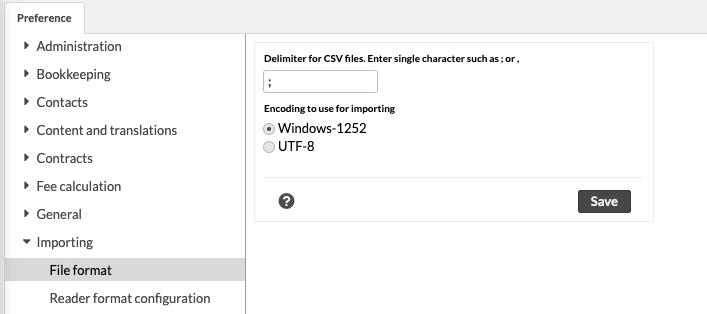

To increase the support for special characters we have added the support of UTF-8 encoding. In preferences you can select if you want to use Windows-1252 or UTF-8 encoding on your imports. Windows-1252 is the default selection.

If you use some other operating system than Windows the UTF-8 offers a possibility to import correctly the Scandinavian letters ÅÄÖ, with Windows-1252 they have not been correctly displayed after import.

If you need to use the Latvian characters the UTF-8 encoding will show after importing correctly all Latvian special characters. With Windows-1252 they have not been correctly displayed after import.

|

Learn more: Preference - Importingin FA Back reference.

More flexible way to define the price source order used for securities and portfolios

Why?

We implemented a new flexible mechanism to valuate securities and portfolios, you can now define a specific order in which you would like to use the source prices for securities and portfolios. This could be the case when you would like to e.g. evaluate one portfolio with different currency cross rates than the other portfolios.

Who is this for?

This feature is for users who have the need to explicitly define which price sources and in which order to use for different securities and portfolios. If you always use one Close price this feature is not relevant for you.

Details

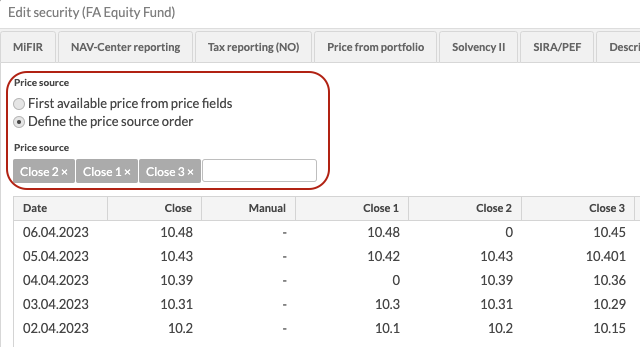

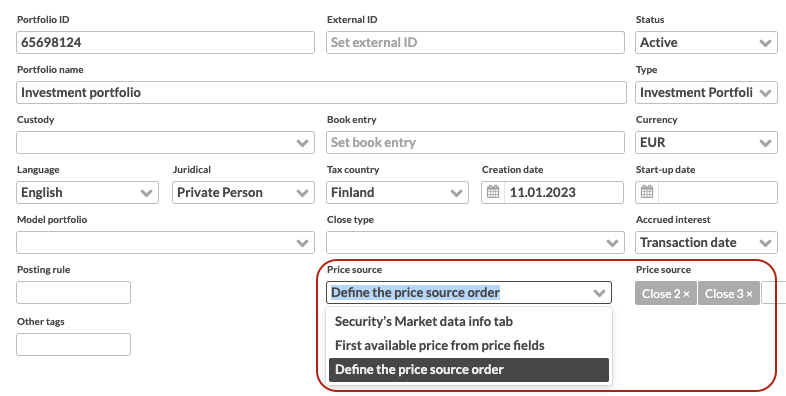

To make it more flexible to define what price source to use for a security or a portfolio there is now a possibility to define in which order the source prices should be used. This is available both on security and portfolio level.

There could be situations when you usually want to evaluate securities in the “default” order, meaning first available price from the left but for security X you always want to evaluate primarily with Close 2, then if that is not available then use Close 1 price. This is now possible with the new improved source pricing.

When evaluating portfolios you do now have a possibility to evaluate with more price sources, previously it was only possible to evaluate with only one price source. You can now choose to evaluate each portfolio with its specific price source order, making it more flexible. E.g. you can choose for Portfolio A to always first use price from Close 2 then if that is not available use Close 3 and if that is not available then use Manual price. At the same time you can have for Portfolio B defined to always use Close 3 first and then Close 1 price.

|

|

Learn more: Market data infoand Portfolio windowin FA Back reference.

“Receive date” and “Receive time” fields available on transactions and trade orders

Why?

We have introduced two new optional fields in the transaction and trade order window for you to record when the order was received. With data in these fields it might help you in some authority reporting or if you are following some regulations such as the Norwegian “Foreskrift til verdipapirfondloven”.

Who is this for?

This is for everyone who wants or needs to record when a transaction or trade order was received.

Details

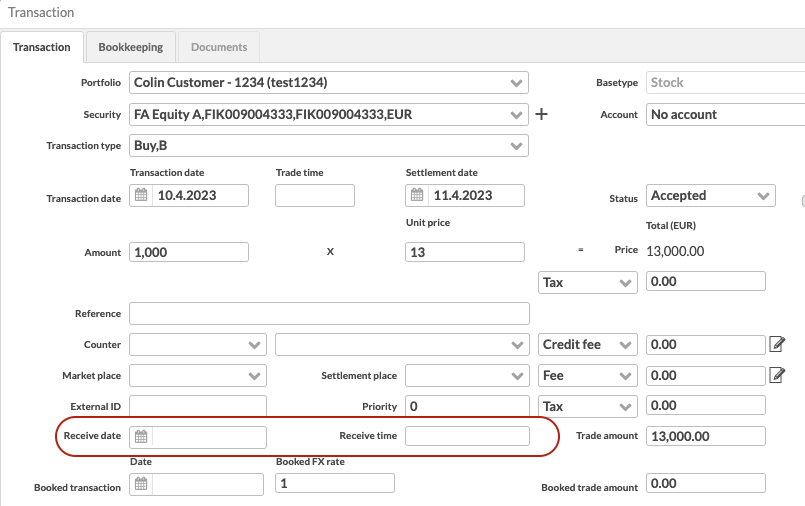

You can find two new fields in transaction and trade order windows, “receive date” and “receive time”. These will make it easier for you to record and save data on when a trade order or transaction has been received.

The new fields can help you find quicker a specific transaction or trade order, since you are able to do searches with the new data and search for more precise transactions. These optional fields are also available when importing and fetching data from GraphQL.

|

Learn more: Transaction windowin FA Back reference.

Possibility to classify representatives with tags

Why?

We implemented this feature because we wanted to provide the possibility to classify representatives on a more granular level than what was possible before. This can be useful in situations when you have e.g. several representatives and you want to distinguish them from each other.

Who is this for?

This feature is for everyone who would like to classify different kinds of representatives on a more detailed level than just with the representative title.

Details

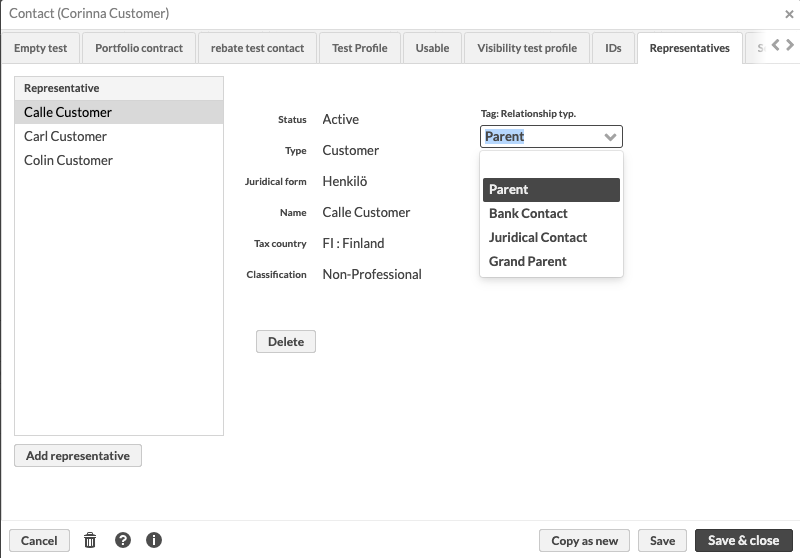

You can classify representation structure on a more detailed level than before. There are situations when you would like to define what kind of relationship a representative, contact or asset manager has. You can now define with tags e.g. who are the parents of a child, who are the owners of a company or any other kind of relationship you would like to define. You can create the tags in Preferences > Tags > Representative tags and assign tags where you have defined the representative, contact or asset manager.

|

Learn more: Representativesand Portfolio windowin FA Back reference.

Improvements in Analytics+

Who is this for?

All FA clients who use the analytics and reporting tool. The improvements include new features and functionality such as grouping options, new calculation methods as well as reporting requirements resulting in new features.

Show holdings percentage and position amount on issuer level in Analytics+

Why?

This development was done to support authority reporting requirements for fund companies in Sweden, Norway and Finland.

Details

New functionality has been added to support grouping for holdings percentage and amount aggregated per issuer level. The new grouping options enables clients to utilize the calculated values directly in reports. This makes it possible for clients in Finland to create the “Notification of major holdings” report and clients in Sweden and Norway to create the “Flaggningsrapport”. The groupings can of course be used outside of the Nordics for additional reporting or directly by the end user in the Analytics+ view.

Learn more: Basic measuresin FA Back reference.

Group positions by customer in Analytics+

Why?

Our existing customers are fond of our standard report “Positions by customer” which lists positions broken down into customer's owning the position. Adding this as a new standard grouping in Analytics+ makes it easier for our user to create their own searches and allows for using the grouping in the Report window for API-based reports.

Details

A new standard grouping “Positions by customer” has been added to Analytics+. The grouping enables the user to group holdings based on the contacts with one search criteria.

Exclude and set fixed values in portfolio strategy settings for Strategy analyzer

Why?

We made this improvement for situations when there is a need to set certain assets in the portfolio to be their own benchmark e.g. when you don’t want to consider the less liquid part of the portfolio.

Details

In some cases when analyzing against a strategy, a subset of the risky assets should not be included and compared with benchmarks. This means that the strategy weights for the included subset should be reweighted to match the included portion of the portfolio. However, a strategy weight that is fixed is not affected by the excluded part and thus not reweighted. The new fields can be used with the strategy analyzer process.

Learn more: Strategyin FA Back reference.

Changed logic for annualized TWR for time periods less than one year

Why?

We made this change to better comply with the GIPS (Global Investment Performance Standards) when positions are held for less than a year. GIPS emphasizes that returns for periods less than one year must not be annualized, and we want to ensure out system produces annualized TWR figures according to the standard.

Details

When positions are held for less than one year then annualized TWR will now show intra-year performance only. Previously annualization was based on start and end date which resulted in displaying slightly off values for less than one-year positions.

We changed the calculation logic of existing columns, which means that the annualized figures you get from FA now will be different from what you got before for positions held less than a year. We did this to ensure any figures the system produces are accurate and according to the standards.

Note

If your portfolios contain positions that are held less than a year, the annualized TWR figures will change after version upgrade. This is important to note especially if you are using these figures for example in your reporting.

This change affects the following columns in Analytics+:

TWR Ann (Annualized TWR, twrAnn)

TWR Gross Ann (Annualized gross TWR, twrGrossAnn)

TWR Bm Ann (Annualized benchmark TWR, twrBmAnn)

Learn more: Basic measuresin FA Back reference.

Exclude effects of taxes on purchase values

Why?

This development was done because our clients needed to be able to calculate purchase value without taxes and costs in their custom reports.

Details

A new field in Analytics+ was introduced “TaxesWithProfitEffect”. This enables clients to utilize the new field in formulas and have the ability to exclude the profit effect of tax. Previously this was only supported for cost.

Learn more: Basic measuresin FA Back reference.

Fixes

Administration

When contact name or ID is updated in FA Back the updated value will now also be updated in User Management.

Changed the audit log messages to be shorter when changing the permission in Preferences. Previously the attachment did contain the full list of permissions, now you will only see for what role the permission was changed.

Logs are now cleaner and don't contain log spam when navigating to Administration > Processes > Artifacts.

Analytics+

The analytics TWR now displays both positive and negative exposure components for the absolute exposure base component when the formula is exported. This previously displayed an incorrect formula as not all the code from the formula was passed on when extracting the TWR info from exposure-based instruments.

APIs

Added correct description into “contacts” endpoint IDs field.

Importer API now allows importing integers/numbers from Forms.

Importer API now also imports Classtype (1) values.

Importer API now correctly returns all fees for portfolios when you update the portfolio, previously the fees were missing when updating portfolio via APIs.

Fixed an issue with how the portfolio’s limit analysis result was returned. Now the data is displayed in the same way as other data.

Fixed an issue with the Swagger UI (API testing page) displaying an 401 unauthorized error when trying to make a call.

Compliance and Investment restrictions

Users with rights to view portfolios and limits can now properly view all limits in all sub tabs in the Portfolio Limits tab.

Corporate actions

Capital Call corporate action is now available in New menu > New corporate action.

When having a structure of two main portfolios with the same sub-portfolio(s) and one of the main portfolios having “aggregation of sub portfolios” as “recalculate values” the corporate actions are now correctly visible only once in the main portfolios.

Dividend as share corporate actions do now correctly calculate taxes for both Dividend as share and Dividend component.

Capital return corporate action, now correctly calculates taxes.

Data aggregation

If importing prices through CSV to a non existing security the importer now shows a clear error message on why the import failed.

Fixed an issue where logs got spammed when importing portfolios without data in the optional fields Accrued interest, Aggregation of subportfolios and Locked.

Portfolio management

Fixed an error where the “Outstanding units” field on Security did show an error message when the field was empty.

Trade order view’s transaction date (ef) column now shows the correct date.

Now you can correctly override FIFO order also when there has been an exchange transaction with the original security.

Transactions listing on the Overview does now correctly show “sent to execution” and “settled in the market” transactions when a specific security is selected.

Some searches on the trade order view did give you an error message, this is now fixed and you should not encounter this anymore when searching for trade orders.

When uploading documents to FA, FA do now also save the media type information. This information is available when doing document searches via API.

Fixed an issue where it was not possible to delete a portfolio if the portfolio ID was the same as the ID of some scheduled event (e.g. scheduled corporate action run) in FA.

When exporting the Portfolio table from Portfolio view, the “Close method” values are now presented as text descriptions instead of numbers.

When a user changes a contact id and contact name the change is now directly visible on contact/portfolio/group selector and a search with the new name and id will result in you finding correctly all the portfolios of the contact.

Now you can remove a contact Classification in FA Back without having an effect on breaking FA Front transaction view.

Report calculation

FA has changed the ex post cost and rebate calculation logic to be based on morning values. Distribution of costs in ex-post costs are based on positions for the same day. Costs booked day one in a fund is based on positions day 0, i.e. if you buy a fund today, you accrue the cost from tomorrow onward. Therefore the ex-post costs should be calculated based on market value start value instead of market value as it has been previously

Reporting

Fixed an issue where portfolios were visible twice on reports when running a report for a parent portfolio as one report.

Dynamic PDF report templates now work without unnecessary errors also when you use dynamic keys to fetch data that is not available. For example, if you try to fetch the third address of a contact with a dynamic key, the report generation no longer results in an error if the contact doesn’t happen to have a third address.

PDF exports from different views now correctly show negative values with a minus sign if your UI is in Finnish, Swedish or English with European number formatting.

If you schedule a report generation via email and later want to modify the email template, the updated email template will now be correctly used in the next report generation.

Trade order management

In trade order execution the status is now changed to executed after you press ok. Previously the status was wrongly changed to executed before pressing ok.

Other

Fixed an issue that prevented an update script to run correctly due to database table being locked in a certain way.

Installing an AppStore package has sometimes resulted in an error message saying “Failed to create Script instance for class…”, this error is now fixed.

Fixed an issue where unnecessary log spam was created when creating a new environment from scratch. The Standard Solution script was trying to be run too early and this did result in log spams.

Fixed an issue in a specific scenario so that the process logs now only prints the relevant information.

Updates to FA Back 3.18

FA Back 3.18.1 Release notes

FA Back 3.18.1 is an update to FA Back 3.18. This update includes the following fixes:

Analytics now gives the correct Price Per unit (PP/unit) on parent portfolio level if at least two sub-portfolios include the same security. The fix also results in that PP/unit is now correctly displayed in the Positions report.

Limited visibility checks now work correctly only through primary contact in the Contact GraphQL API. A user with limited visibility can now only see information if the user is the primary contact.

Fixed a form validation issue – the company info is now validated only when the field is editable.

FA Back 3.18.2 Release notes

FA Back 3.18.2 is an update to FA Back 3.18. This update includes the following fixes:

The sub-portfolios are now correctly returned in GraphQL when querying any portfolio for a contact. This error appeared in the 3.18 major version.

Users with empty spaces in the user name can now correctly log in to FA. This error appeared in the 3.18 version.

Fixed stability issues for asynchronous script during the upgrade. Now if the script gets stopped during the upgrade it will try to run the upgrade again. This error appeared in the 3.18 version.

Fixed an issue where purchase price was displayed as price for the security in situations when “define the price source order” was selected for portfolio and a price for the selected date was missing.

Spot leg of FX swap is now created with the correct report FX rate and is correctly taken into account in the TWR calculation.

A transaction with return effect, that is linked to a security for which there is no position, does now get the return correctly put on the account subitem. This is usually the case for management and performance fees in fund portfolios.

Database schema updates can be heavy and should not update automatically. This is now fixed so that it will update only when planned.

FA Back 3.18.3 Release notes

FA Back 3.18.3 is an update to FA Back 3.18. This update includes the following fixes:

Fixed an issue where the “Groups, Contacts, Portfolios” selectors were empty, now you can see the lists as expected. This error appeared in the 3.18.2 version.

FA Back 3.18.4 Release notes

FA Back 3.18.4 is an update to FA Back 3.18. This update includes the following fixes:

Fixed an issue where GraphQL API returned empty lists for parent and sub–portfolios. The portfolio list now gets the correct data.

FA Back 3.18.5 Release notes

FA Back 3.18.5 is an update to FA Back 3.18. This update includes the following fixes:

Fixed an issue where extra tags were added to trade orders and transactions. This happened if there was a tag group that was hidden from the user's user role. If the user created a new trade order or transaction, all hidden tags were added to it. This issue was introduced in the 3.18 version.

Fixed an issue in GraphQL API where introspection queries didn't work as expected, produced an error message, and at the same time spammed the logs with errors. This issue was introduced in the 3.18 version.

FA Back 3.18.6 Release notes

FA Back 3.18.6 is an update to FA Back 3.18. This update includes the following fixes:

Importing numbers and boolean/checkbox values from forms to profiles now works as expected. The issue appeared in the 3.17 version.

Importing fields with nested values, such as file uploads, now works correctly. The issue appeared in the 3.18 version.

We changed the following validation: if a contact with the given identifier exists, and the user has (extended) limited visibility, the user is allowed to view this contact. The issue appeared in the 3.18 version.

Pre-trade limits are now calculated correctly on the main portfolio level in a portfolio group consisting of main and sub-portfolios.

Fixed an issue with a displacement of the login icon and some other icons on the right hand side of the window. The issue appeared in the 3.18 version.

Fetching a user’s linked contact through GraphQL API no longer logs an unnecessary error when there is no linked contact.

Fixed an issue where combining report packages sometimes resulted in reports missing or empty in the combined report package. This happened if you combined a “single date” report package together with a “time period” report package. In those cases the “single date” report package was missing.

FA Back 3.18.7 Release notes

FA Back 3.18.7 is an update to FA Back 3.18. This update includes the following fixes:

Fixed an issue where form parsing failed if the form had conditionally visible fields dependent on boolean/numeric values. Depending on the placement of the field, all the form validations could have been skipped on the server side.

Importing contracts with AUTO account settings now picks up the shared accounts correctly if the portfolio does not have any “own” accounts.

Custom import mappers now work correctly. A bug in version 3.18 resulted in failed imports when using a custom import mapper and changing the decimal separator from semicolon to comma.

Fixed an issue where the profit was calculated twice for coupons, which resulted in the wrong TWR. The profit was calculated both on bond and the bank account, now the profit is calculated correctly only once. This issue appeared in version 3.18.2 version.

It’s now possible to schedule a report package with a single report date correctl.

Report packages with e-mail templates that are created before the 3.18 version now work as expected. Due to error in version 3.18, the email templates did not work until the user rselected the e-mail template and saved the package again.

FA Back 3.18.8 Release notes

FA Back 3.18.8 is an update to FA Back 3.18. This update includes the following fixes:

Fixed an issue where transaction imports occasionally didn’t trigger report calculation, resulting in the transaction’s effect not being visible in portfolio’s positions.

Fixed an issue in TWR calculation related to a short position receiving a coupon resulting in incorrect -100% TWR. The calculation of market value base now considers net cashflows for short positions correctly, ensuring subsequent profits result in correct TWR.

Cashflows from an FX Forward contract are now generated with correct "Report FX rate" also when neither of the cashflows is in portfolio currency. In such a case, the system now sets the FX rates of the cashflows so that they combined are equal to the contract FX rate.

Fixed an issue in scheduled report generation, and scheduled custom jsreports scheduled with a dynamic date no longer produce an unnecessary error.

Automatic user linking that happens in the background when a user is automatically created (for example through self-onboarding in Client Portal) now works correctly even if the contact the user is going to be linked to is not available from the start. The linking is now done when both the contact and the user are available, allowing clients to directly log in.

Additional fixes to ensure cosmetic updates to transactions no longer trigger unnecessary report calculations and posting rule runs in any scenario.

Additional fixes in the background to make sure market prices are handled correctly throughout the platform also when a security is using a prioritized price source order.