Monthly savings in FA Client Portal

The user can set up a monthly savings plan to generate scheduled deposit transactions for portfolios. The user specifies the amount to deposit and defines the schedule, and the FA Platform automatically creates transactions based on the information entered.

The deposit transactions are generated with a "Not finished" status and you can manually update them as "Accepted" if the user has made a manual payment or collect them using direct debit.

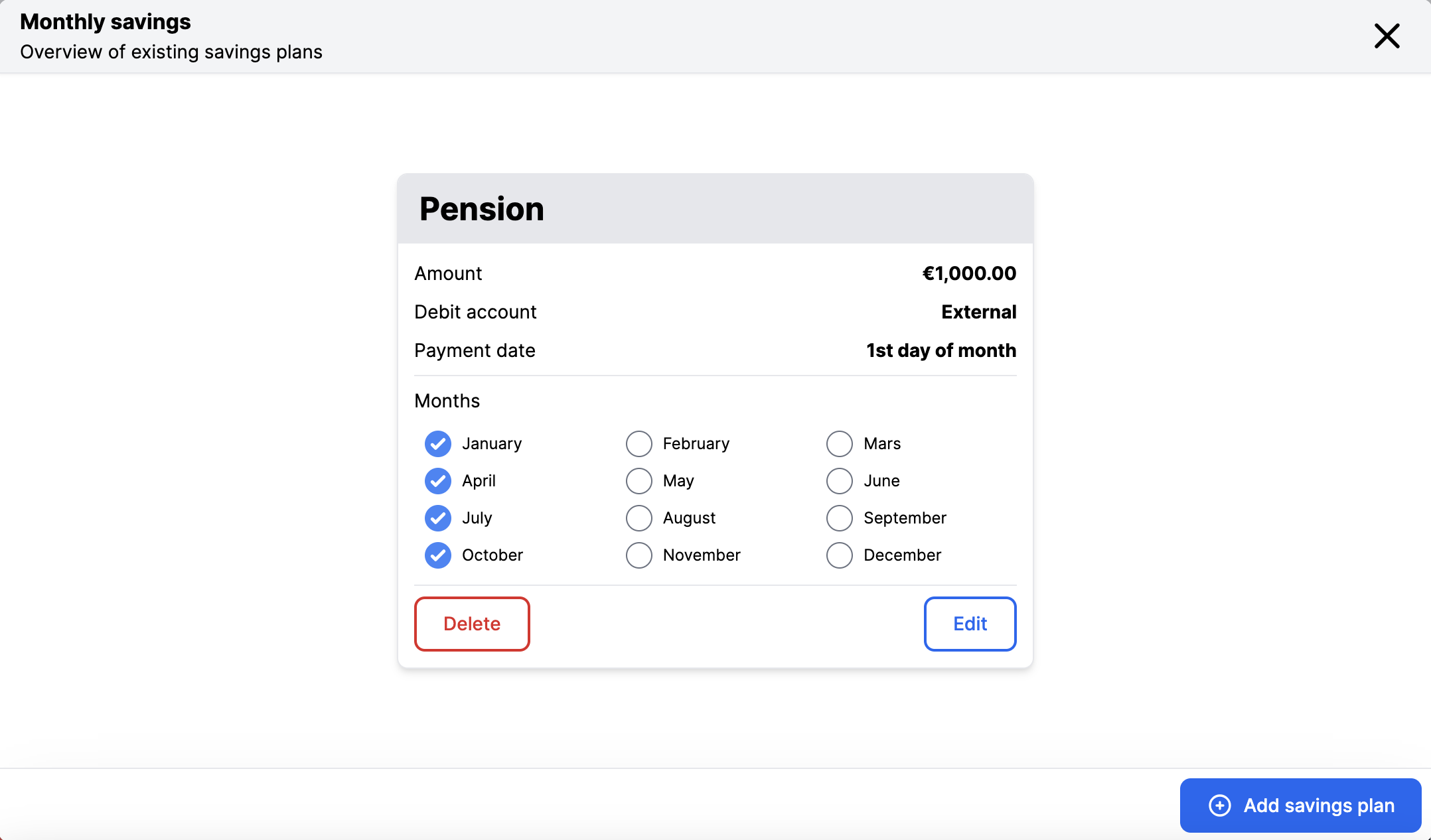

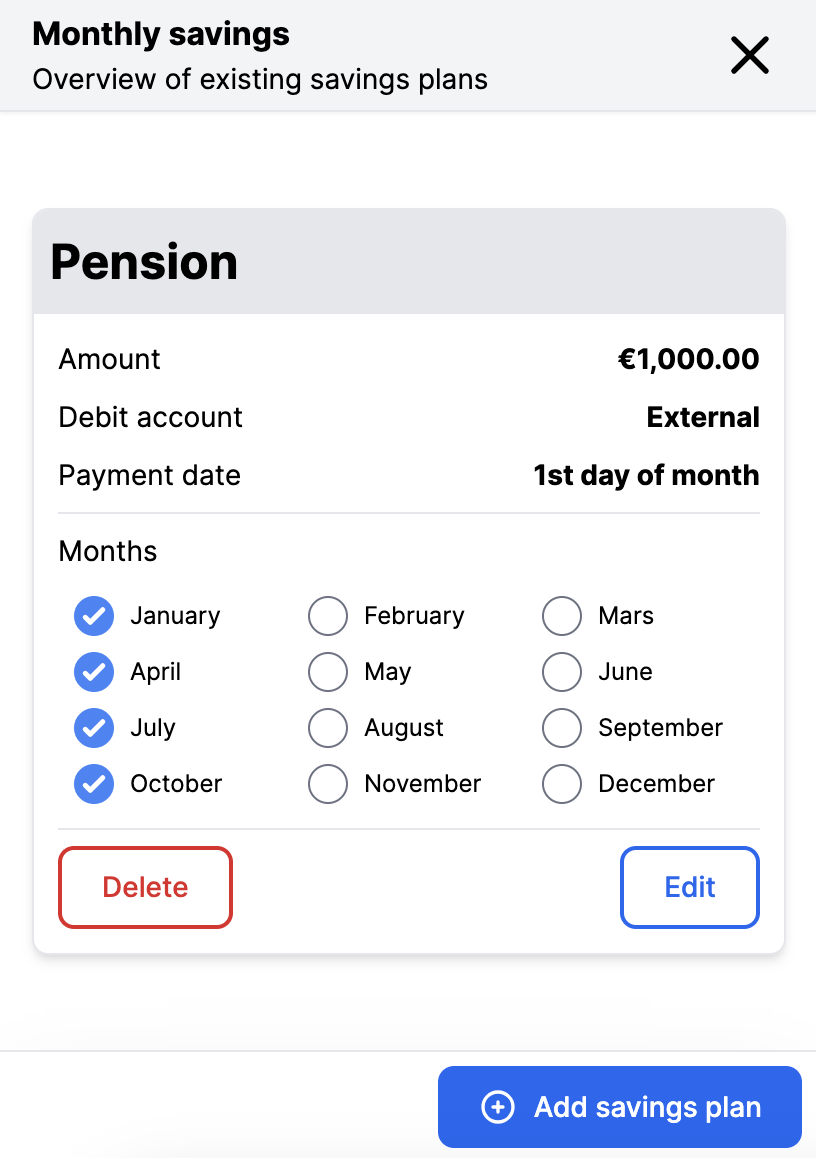

The user can view, edit, and delete their existing savings plans in the FA Client Portal by selecting Monthly savings in the top-right menu.

|

|

Enable monthly savings in FA Back

To enable the monthly savings functionality for the user in FA Client Portal, include the client's portfolios in the CP_MONTHLYSAVINGS portfolio group in FA Back. The user can only set up savings plans for portfolios that are included in the CP_MONTHLYSAVINGS portfolio group.

Add a savings plan

To add a savings plan in FA Client Portal, the user needs to select Monthly savings in the top-right menu, click on Add new savings plan, and fill in the following information:

- Portfolio and amount to save section

In the Portfolio and amount to save section, the user selects a portfolio from the drop-down menu and enters the amount to be saved monthly. The portfolio selection only shows portfolios included in the CP_MONTHLYSAVINGS portfolio group.

You can define a minimum monthly saving amount per portfolio by adding the portfolio key figure CP_MS_MINAMOUNT in FA Back.

- When to save section

In the When to save section, the user enters a monthly payment date for the deposit transaction. They can also uncheck the months they do not want to include in the savings plan. The user can also see the resulting amount of savings per year in the portfolio currency, and the value updates according to the number of months selected.

- Summary section

The Summary section allows the user to confirm that the information they entered is correct before confirming the savings plan.