Standard Solution November 2023 - Release notes

Released: December 1st, 2023

Standard Solution December 2023 introduces a new way to split executed trades to multiple portfolios, along with other smaller improvements and fixes.

Split executed trades to multiple portfolios

Why?

This feature was implemented because sometimes there is a need to split bulk- or single trades after the trade has been executed, as opposed to defining the split in advance as is done with our current trade order bulking.

Who is this for?

This feature is for everyone who needs to split a trade into multiple portfolios after the trade is executed.

Details

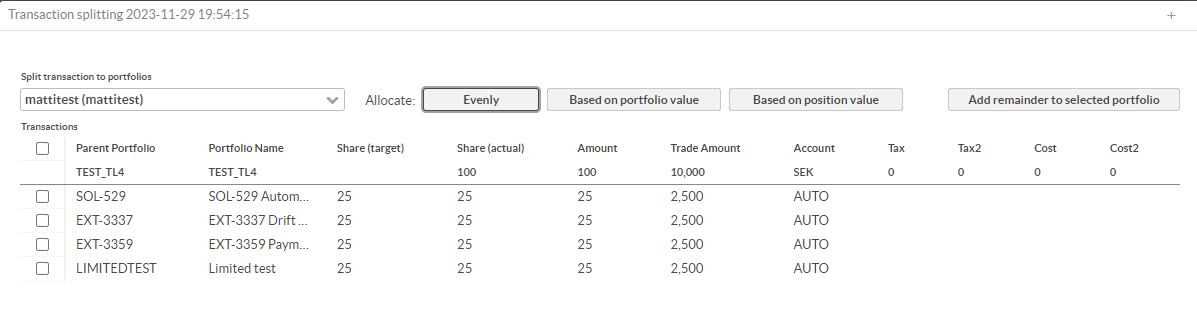

When you handle many trades on behalf of multiple clients, you can use trade order bulking if you know the split in advance. If you don´t know the split in advance and need to split the trade to multiple portfolios after execution, you can use the new Split transaction to portfolio process.

The process has three allocation options – you can choose to allocate the transaction evenly to each of the selected portfolios, or split it based on portfolio value or based on position value.

Learn more: Split executed trades to multiple portfolios in FA User guide.

Other improvements

Reconciliation

MT535 Statement of Holding export has been improved to include additional data that some custodians/counterparties require.

To ease the onboarding of the new reconciliation feature in upcoming FA Operations application, we have added a helper process that takes in the same data as old reconciliation processes, and pushes that data to FA Operations.

External Reporting

Finnish tax report VSULKOSE now has a new field (058) "Year of payment" to be compliant with the latest specifications from the tax authorities. The year in field 058 is based on the year of the dividend settlement date.

Finnish tax report VSRKOERI now has new options for beneficiary type and some fields changed to being mandatory to be compliant with the latest specification from the tax authorities.

Finnish tax report VSAOUUSE now reports transfer tax to field 150 if Role is 1 and transaction is buy or sell. If Role is 3 or 4, it reports only sells, transfer tax from sell is reported in field 150 and transfer tax from related buy to field 163.

Finnish tax reports VSAPUUSE, VSTVERIE, VSULKOSE, VSRKOERI now use the ddMMyy format for the date of birth. If the birth date is not known, ddMMyy-UUUU is used.

Norwegian international reporting (CRS/FATCA) is now created as a separate XML-file and not as a part of the regular tax reporting file, as it previously was. The change was done to be compliant with the latest specification from the Norwegian tax authorities.

Fee Management

Rebate calculation process will now add taxes automatically to rebate transactions if default taxes are defined.

Configurable fee formula now has an option to apply security-specific fee percentages. Learn more: Configure a fee formula in FA User guide.

Settlements

Settlement instruction files to Swedbank now include

90A::DEAL//PRCT/(price)for fixed income securities, and:90B::DEAL//ACTU/(currency)(price)for equity securities. The fields were added because Swedbank now requires them to be populated in the files.

Portfolio Management

When running mark-to-market transactions for futures, it is now possible to set a FX rate. By default, the latest market FX rate from the system is used.

Mark-to-market process now take into account intra-day transactions and include profits from those. Mark-to-Market transaction is still generated as it used to be as one of it’s effects is to adjust the purchase value of the open position. An additional transaction is generated that includes both the Mark-to-Market of the open position and the profits from the positions closed that day.

Fund Management

New transaction type FMDWD, Dividend withdrawal - Fund added. This type is used in fund management to take out the paid dividend (cash) from the fund.

Accounting

SIE bookkeeping file export now also saves the SIE file in a task, so that file is easily accessible at a later stage if needed.

Deferral of bond purchase price now uses a separate transactions type, because sometimes both Deferral of other securities and Deferral of bond purchase price is used, and there is a need to differentiate them in reports and accounting.

Fixes

Payments

Fixed an issue that could cause mandate cancellation files to not be created.

Monthly investments/divestments configuration now uses Subscription (SUB) and Redemption (RED) transaction types to be compatible with Standard Solution transaction types.

Trade Order Management

The trade order bulking process no longer ends up in error in scheduled runs due to missing fee type.

Fee Management

Configurable fee formula periodic fee formula option to include sub portfolios now works as it should. Previously it was always excluding sub-portfolios.

External reporting

AIMFD reporting process no longer gives an error if the field “Type of reporting institution (FIVA)” is not filled in.

Reporting

Limits report header now works better when run against a large group of portfolios. Contact names no longer overtake a large amount of the report space.