Fixed and floating rate bonds

To manage fixed or floating rate bonds, define the coupon payment information in the security properties. The system calculates the accrued interest for positions automatically. You can track key bond indicators and handle coupon payouts and expirations with corporate actions.

Create a fixed and floating rate bond

To create a fixed or floating rate bond:

Choose New → New security in the top menu. The Security window opens.

Fill in the necessary fields. The following fields are specific for fixed and floating rate bonds:

Basic info tab:

Set "Bond" type.

Note that bonds are usually valued as a percentage of par. You can make this work in FA system by entering "100" in both Multiplier fields.

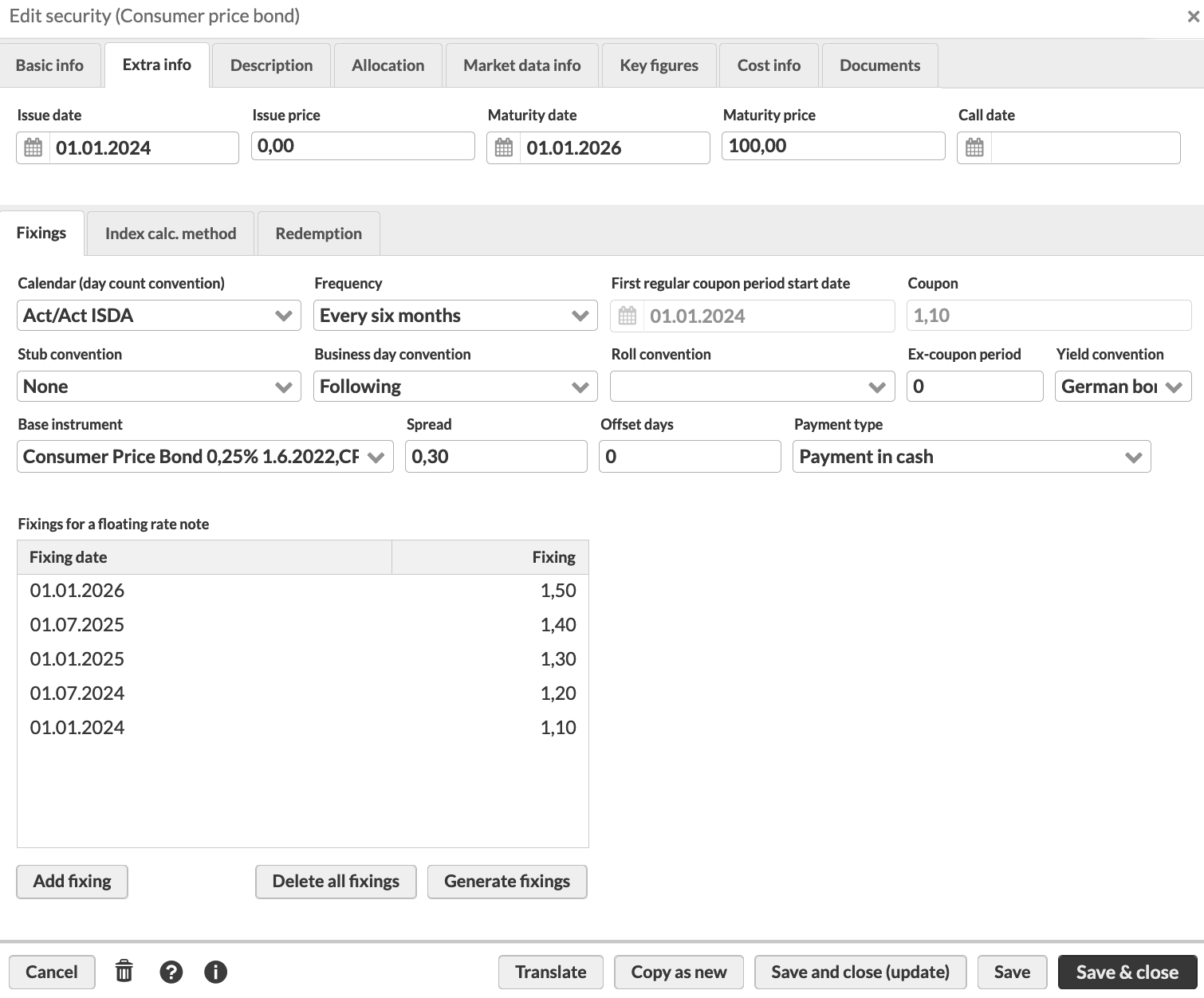

Extra info tab: define the coupon payment settings

Dates and prices at the top.

Fixings information in the Fixings subtab. For a fixed rate bond, enter the calendar, frequency and fixing values. For a floating rate bond, enter floating rate per fixing date.

For the full list of fields in the Security window, see Security window in FA Back reference.

Buy and sell fixed and floating rate bonds

To buy or sell a fixed or a floating rate bond, create a buy or sell transaction. Accumulated coupon with accrued interest is bought and sold together with the bond. To include it in the transaction:

Define the transaction date and settlement date.

Type "?" in the Accrued interest field.

As a result, the system calculates the accrued interest amount up to the settlement date and includes it in the transaction's trade amount.

Note

You can use deferral of the bond purchase price to split the payment in several transactions. For details, see [Extension] Bookkeeping - Deferrals

Track accrued interest on fixed and floating rate bonds

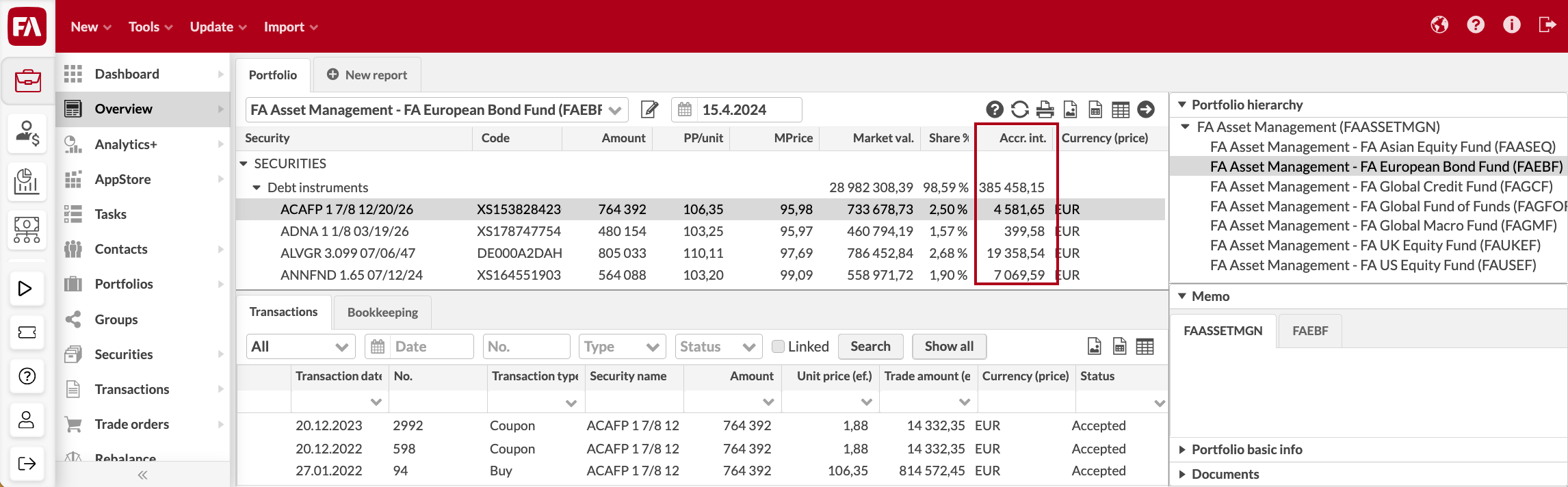

The system calculates the accrued interest for the position. You can check the accrued interest:

In the Overview and Analytics+.

In the Positions view.

Note that the accrued interest between the transaction and settlement date is fetched from the transaction.

Make a coupon payout

To generate coupon payment transactions on your bonds, you need to create and run a corporate action. You can schedule corporate action runs to repeat them regularly. Use one of the tools that suits you best:

For a coupon payment on one bond, follow the steps in Record and run corporate actions to client portfolios.

For coupon payments on multiple bonds, import corporate actions in a file (see File format for importing corporate actions) and run them from the Corporate actions view in FA Back (see Record and run corporate actions to client portfolios).

For coupon payments and expirations on all bonds in the system, use the functionality described in Mass-generate corporate actions.

Note

You can use deferral of accrued interest to postpone the payment. For details, see [Extension] Bookkeeping - Deferrals

Monitor key bond indicators

Convexity and duration for bonds are shown as columns in the Securities view.

You can monitor and aggregate key bond indicators, such as yield, convexity, and duration, in Analytics+. For details, see Analytics+ in FA Back reference and Monitor portfolios with debt instruments in Analytics+.